I return from Carmel, where we went to my second presentation on the HPP. They stated that they were averaging almost $1million in sales a month, which to my math is 50k HPP a month, and almost 80% were going to "Hybrid" owners - folks who also own in the HRC. I do think we have a lot of HRC owners at Carmel who bought through the Developer so perhaps they are more likely to Go Hybrid than a Resale owner. Sounded like a tough sale for new owners without any points, though.

Originally they stated there were two options for HRC owners. First, Hyatt could purchase the HRC deed back, and then you could use the funds to apply to a HPP purchase. Second, you could purchase HPP on top of HRC.

When they learned we had purchased on the secondary market, they said option #1 was out of the question. (Later on, they admitted that one would not have that much savings at all on a buyback because Hyatt doesn't offer much.)

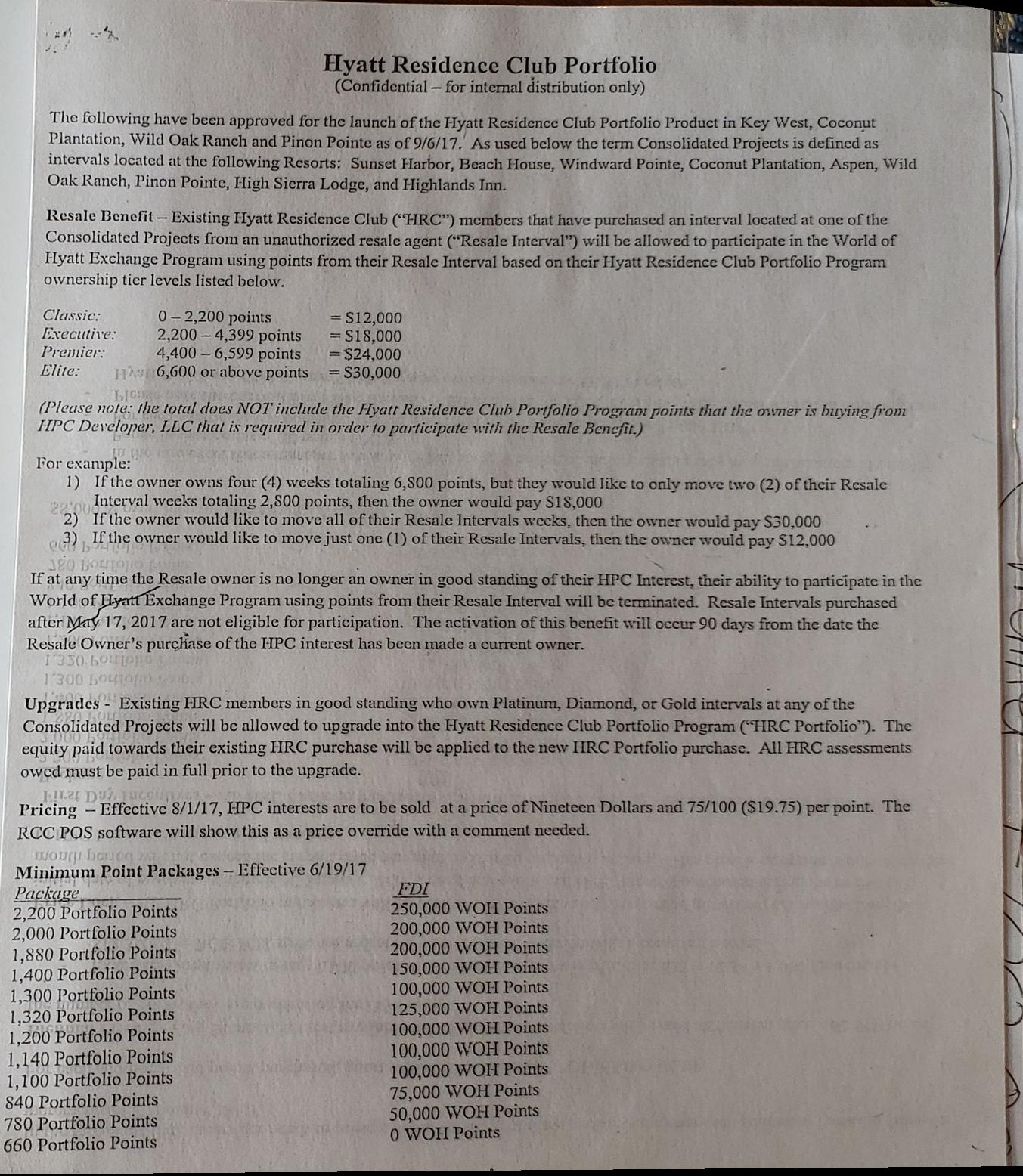

So "Resale HRC" owners are in a specific group (imagining many of you are in the same group) and this is what I found out they have for us (sorry if you have seen this document before, I hadn't so thought it might be interesting):

This shows how much needs to be spent in raw dollars to "bless" our "unauthorized" resale.

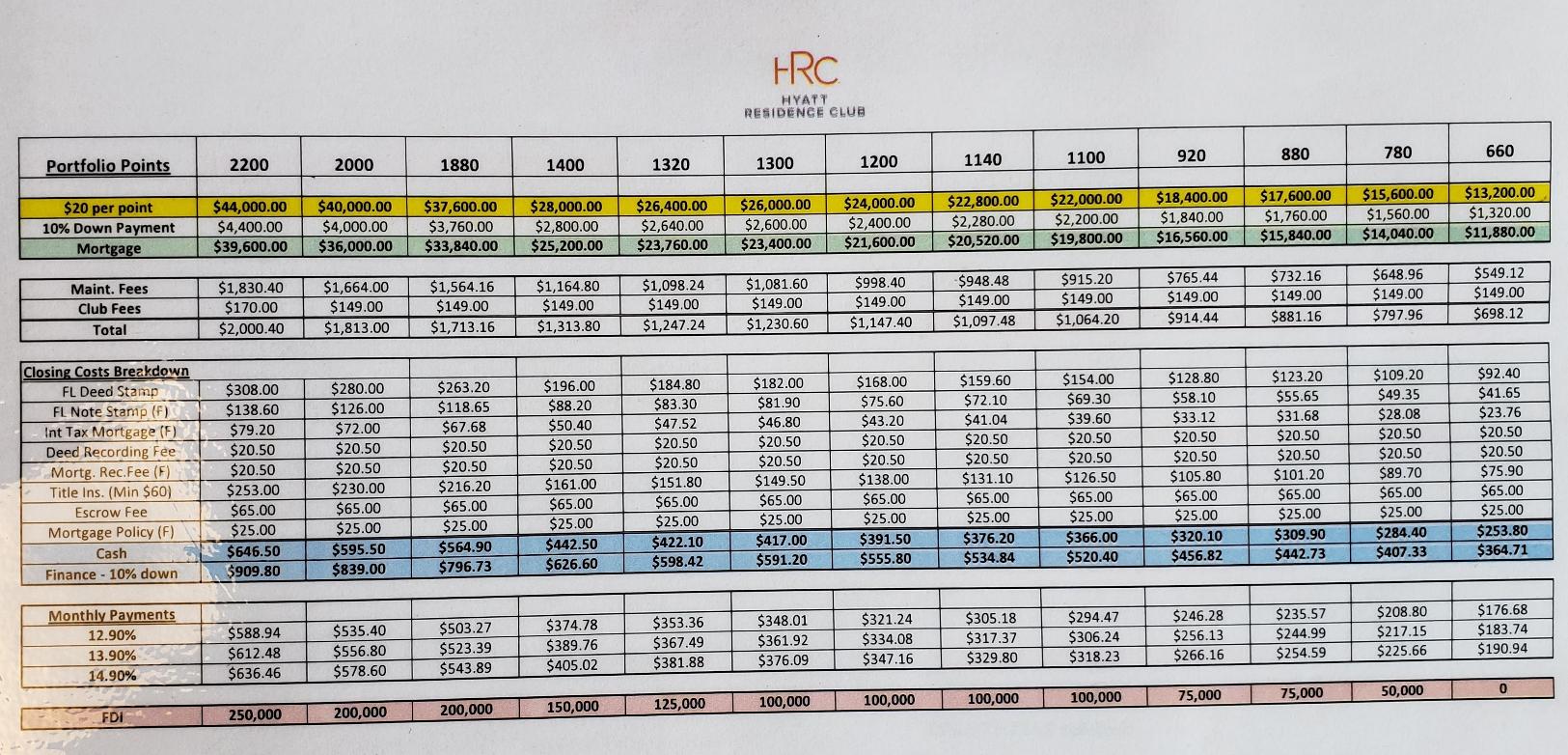

From my last visit in June, and the sales figures they quoted me now, I believe we are still at the same cost per point ($20):

On top of this, they were slimmer on specials, but honestly I didn't push them for a good bargain to be mindful of everyone's time (they were looking a little sad): they didn't lead with a free interval week or two, no free HRC week or two, and just the standard FDI of WOH points. They also had the closing special to freeze the rate.

I completely forgot the June 2018 presentation but old me and new me came to the same conclusion - no way. I'm writing this here to remind myself...

To be able to deposit my 2,000 unit into HPP on an annual basis would cost $13,200 and I would end up with 2,000+ 660=2,660 HPP possible ("Executive").

To be able to deposit my 2,950 unit into HPP on an annual basis would cost $18,400 and I would end up with 2,950+ 920=3,870 HPP possible ("Executive").

To be able to deposit both 4,950 unit into HPP on an annual basis would cost $24,000 and I would end up with 4,950+1,200=6,150 HPP possible ("Premier").

(trivia: theoretically, someone wanting to get the Elite tier as efficiently as possible would want to start with 5,400 HRC points and spend $24k... not me...)

The benefits touted of HPP at this time by sales folks are:

. Reservation Request Advantage (Request List) - X-month Reservation Request Advantage for 1 reservation up to 7 nights (Classic/Executive/Premier) / 1 reservation up to 14 nights or 2 reservations up to 7 nights each (Elite), to access reservation in the HPP pool, where X=15/16/17/18 for the Classic/Executive/Premier/Elite.

.

Accomodations Confirmation - (this one was nice if not pricey) Confirm the specific unit number/floor/view for an additional Y Portfolio points, where Y=100/75/50/25

.

Stay One Day Reservations - use Portfolio points to book one-night stays up to 72 hours prior to day of arrival at a M discount, where M=0/0/10/30

.

Boost Portfolio Points - Bank Portfolio points for an additional 2 years, borrow from future years up to 6 mo from arrival day.

.

World of Hyatt Points - Convert any number of Portfolio points into WOH points at a rate of Z WOH per Portfolio point, where Z =41/43/45/50.

Besides the $20/pt upfront cost that made this a non-impulse buy are more importantly for our family:

1. No resale value of the HPP. Yikes.

2. Annual Fees and $133 HRC->HPP deposit fee. My 2,000+2,950=4,950 HRC points currently cost me ~$3,200/yr in annual fees or $0.64/pt. Spending $0.96/pt in annual fees is rough, plus add the (in the Papa Bear option of both units converted) $266/yr to deposit two HRC units into HPP - it ends up costing $1.18/pt, nearly double what I spend now. It's like they gave up on annual fee management.

Also my reservation fee of $60 under HPP is higher than $41 with HRC.

3. Too Complex. I know they talk about simplifying the Legacy CUP/LCUP program but the units our family covet are the five two-bedroom Carmel units, which all are in the HRC pool, as they were sold out years ago from the Developer.

So now every year we have to choose whether to deposit one or two HRC weeks into the HPP pool and spend the $133/yr per week? It just seems like too many decisions with too many unknowns, and we wouldn't want to spend $24k plus $1,400/yr in annual fees to regret depositing into HPP. Better just to not see the Portfolio units available on the web site - don't worry, be happy.

4. World of Hyatt. The old Developer benefit I gave up in Resale, it used to be 2,950 -> 120,000 or 2,000 -> 82,000 which was 41 WOH per HRC point. I never cared much for it, but it doesn't seem like a strong enough conversion to make this all worth it. Perhaps we're biased since we never had WOH benefits.

PS: The sales person made it sound like if you own (Developer, Resale) HRC in a resort you still get some sort of priority in booking CUP for that resort. That is news to me... is this true?