November 2021

Dear Fellow Virgin Grand Villas Condominium Association Owner:

As your owner-elected members of the Board of Directors, we recently participated in a meeting of the Board. The November meeting is traditionally the one at which we settle on and approve the budget for the coming year. Maintenance fees are based on that budget.

Budget and Maintenance Fees

This year, the management company proposed a budget that would require a 14.5% increase in maintenance fees. The proposed budget was mailed to you in October. The main drivers of the increase are as follows:

- Increased property insurance costs are the main reason. They amount to an average of $441.55 per unit week, a 52% increase over insurance costs for the year 2021. The main reasons for this big increase are as follows:

- The value of the property was assessed at $65 million, rather than $41 million. The appraising company had been using mainland rather than Virgin Island replacement costs.

- The property had been undervalued in the previous appraisal.

- The Developer (Marriott Vacations Worldwide) has now required the condominium associations to pay for insurance on the common areas of the resort, such as the pool and lobbies.

- Note: another insurance increase is expected in 2023, because the premium rate was kept flat this year but may increase next year. Property insurance rates are going up nationwide because of the fires in the western U.S. and the condo collapse in Florida.

- Maintenance Fees Delinquencies. Nearly 9% of owners have not paid their maintenance fees and are locked out from using their ownership. The management company projects bad debt in the 2022 budget at $734,990. The other owners must pay the delinquent owners’ share of the fixed costs of the resort. Owners therefore must pay an average of $157 per unit week for this bad debt, an increase of 9.9% over 2021.

- Increased housekeeping and administrative costs average $23 per unit week. The cost of housekeeping is $271 per unit week, an increase of 6.2% compared to 2021. Part of this is due to higher cleaning standards, and part to market rate adjustments for labor costs as a result of COVID-19.

- The condominium associations pay for gas and electricity for the common areas. This amounts to $83 per unit week (in addition to $221 per unit week for the utilities for the villas), an increase of about 75%. This is also impacted by the very high rates charged in the Virgin Islands for electricity.

- Our Management Agreement specifies Management Fees are to be 10% of the billed expenses to owners (as computed before that 10% is added). With overall fees increasing, the amount paid to the Management Fee has also increased, now averaging $257.78 per unit week, an increase of $33 per unit week.

The Hurricane Irma insurance expense

Our insurance deductible fund, created to cover the 5% deductible on the insurance policy, had a balance of $3,067,659, adequate to cover our maximum risk at the time. In fact, the amount we had to pay was $1,068,311 toward the hurricane damage. Therefore, at the end of 2021, the fund was reduced to $1,999,348. The new insurance policy raises our maximum risk for damages from a tropical storm or hurricane to 5% of $65 million, the new insurable value of Virgin Grand and our proportion of the common areas. So we need to increase the fund, over a period of years, from just under $2 million to $3.25 million, to account for the potential of another large tropical storm or hurricane. In 2022, we are making a very modest start on rebuilding the fund by contributing $100,000 for this purpose, about $20 per unit week.

Reserves

An independent company retained by the association reported that our reserves for future replacements of furniture, equipment, and the walls and roof were not adequate. We are adding an average increase of $25 for these reserves. Even with that increase, the reserves will not meet the needs for future replacements. Either additional increases will be required in future years, or the Board will need to invest a portion of the funds in the reserves in equities, as other boards (including the board of Coral Vista) have done, rather than having it all in low-return fixed-return instruments. We took no action on this item but will be considering it in the future.

The budget was approved with one abstention

We recognized that even a 14.5% budget increase, with more increases likely in the future, was not affordable for many owners. We therefore notified the Developer before the meeting that owners in Virgin Grand needed the Developer to establish a reasonable repurchase plan before we could support an increase of that magnitude. As noted below, the developer announced its willingness to accept relinquishment of deeds by owners in good standing, but it is not offering any cash back. We do not regard that as a reasonable “repurchase” plan.

However, the Board of Directors could not refuse to approve any budget for next year because that would have required laying off staff, canceling reservations, and closing Virgin Grand. The two Developer-appointed directors and one of us (Futransky) therefore voted to approve the budget, and the other of us (Schrag) abstained.

“Repurchase” plans

Marriott Vacations Worldwide is offering a Foreclosed Inventory Purchase Agreement to the Association which will provide an opportunity for the Association to remove foreclosed inventory from our balance sheet. Based on this agreement, in the Spring of 2022, the Developer will buy from the Association all the units on which the Association has foreclosed and which by then have been transferred to the Association. It will pay a year’s maintenance fee plus up to $2,000 for each such unit and will pay maintenance fees on those units until it sells them. However, if any Virgin Grand owner wants to make a better offer for ALL the unit-weeks in our inventory, the Association is willing to entertain offers of at least $110,000. We are not willing to consider offers for less than all of the unit-weeks. If you want to make a purchase offer, you must contact Philip Schrag (email below) within ten days of receiving this email and be prepared to make a binding commitment to the purchase very soon thereafter.

A list of our current inventory showing the type of unit and the week is appended to this report.

Additionally, owners who are not current on Association financial obligations, may choose to take advantage of another plan currently being offered. If you are in this category, you may, for a limited time, relinquish your deeds and be freed of past and future obligations. To take advantage of this offer, call Vistana’s Financial Services department at

1-800-895-5386.

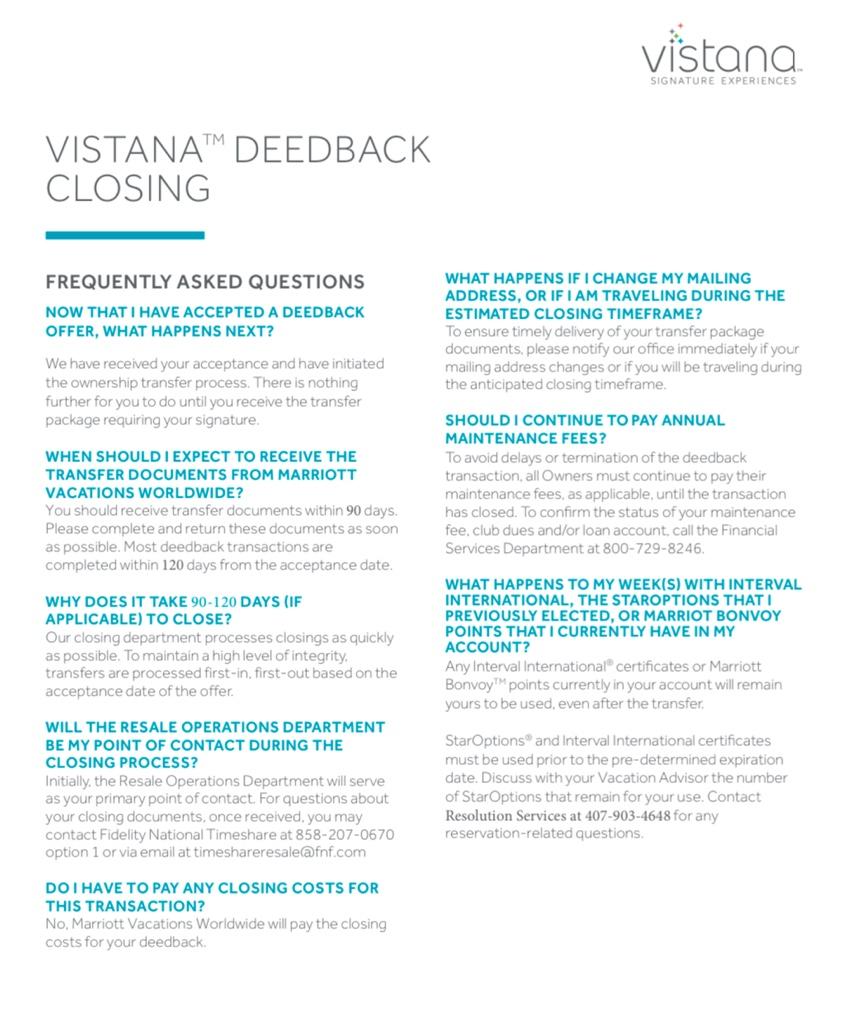

Lastly, owners who have fully paid their maintenance fees may be eligible to relinquish their unit(s) to the Developer. To explore this option, call Vistana’s Resales department at

1-866-682-4547 during normal business hours Monday through Friday. Do not expect to receive cash back for your unit-week(s). If you call, you will probably be required to sign a relinquishment contract very quickly.

As to the future, the developer has stated that the existing offer from Resales reflects current market conditions, relative to available supply of Virgin Grand inventory. As market conditions evolve, and the supply and demand balances shift, the deed back offer could certainly evolve with it in the future. While this is not a firm commitment of a specific change, it is safe to assume future offers for Owners will reflect market conditions at that time.

Lemongrass

The Lemongrass restaurant at the resort has been closed since Hurricane Irma in 2017. Since the resort reopened late in 2018, the management company has been exploring various options to reopen Lemongrass. As we relayed in our September report, the management company expected at that time that it would have the restaurant running early in 2022. Management still hopes that will be the case but was unable to assure us that Lemongrass will be fully open by then. However, by December it should be serving breakfast regularly, and it is planning to offer themed dinners on some nights. Lunch and dinner service will remain available at Snorkels.

COVID

On November 2, when we met, there were no known cases of COVID-19 on St. John. It is still necessary, however, to have a negative COVID-19 test within five days before traveling to the Virgin Islands. It is possible that in the future travelers will instead be able to upload proof of vaccination.

HVAC improvements

A contractor is now completing the improvements to the air conditioning systems that had to be repaired or replaced after the damage caused by and in the aftermath of Hurricane Irma. Many units will have new ducts, filters, and other components of the systems.

Wall for Buildings 41 and 42 (and 4415)

For at least ten years, most owners in these buildings have asked for the sliding panels separating the two upstairs bedrooms to be replaced by a solid wall, offering occupants much more privacy. Starwood Vacation Ownership had told us this construction would require the affirmative vote of every owner of a particular unit, but the Board requested an opinion of independent counsel, and the counsel reported that the walls can now be constructed. During 2022, the Board will consider the modest expenditure that will be required so that the walls can be constructed during 2023.

Developer turning majority control over to elected directors

Until now, the Board has consisted of three directors appointed by the Developer and two elected directors. The Developer has decided to complete turnover of the Association, requiring the Board to consist of a majority homeowner-elected representatives. Henceforth, the Board will be comprised of two directors appointed by the Developer and three owner-elected directors. Therefore, at the 2022 Annual Meeting in March, you will elect two directors, one for a three-year term and one for a one-year term. David Futransky is the third elected director, as he was chosen by the membership last year to serve until the Annual Meeting in 2024.