- Joined

- Mar 9, 2014

- Messages

- 4,206

- Reaction score

- 3,123

- Location

- Novi, Michigan

- Resorts Owned

- QH, HBC, VBHC, & Pinestead Reef

I believe after welk and Hyatt are integrated it will be on the market again.

I bet that is exactly what will happen...

I believe after welk and Hyatt are integrated it will be on the market again.

My understanding is that we have a deeded week, and that deeded week is for us to reserve. So it is in some "hold never never land" It is out of HRC inventory for other to book. We either elect to occupy our home club or not. If we choose it not stay home and get either CUP points or HPP point instead-- then the unit get release to its respective pool.If an owner tries to get the unit back from CUP during the HRPP period, it's gone and not retrievable. Your account shows it as gone from HRPP and the points are in CUP. It sounds like you are suggesting it goes to a "never, never land" floating category until 6 months?

From what I have been reading, it seems that the HPP system was built and but did not provide a real incentive to join. When I converted Welk weeks to Welk points the incentive was access to the new resorts. Neither Cabo, Northstar, Breckenridge, the "experience collection" et al are available to owners that do not own points; the weeks owners only get weeks at their resort (either fixed or float).

And when I converted Northstar and Breckenridge were not even part of the collection. The resort expansion provided increased value to the points I already owned.

It sounds like we are saying the same thing. The owned unit is in HRPP for 6 months available only to the owner to book. If for example, the HRPP owner books something else with those points at say 2 months, at that point the HRPP status is removed and the unit is made available to the Club via CUP. It is not held in abeyance for the remaining 4 months.My understanding is that we have a deeded week, and that deeded week is for us to reserve. So it is in some "hold never never land" It is out of HRC inventory for other to book. We either elect to occupy our home club or not. If we choose it not stay home and get either CUP points or HPP point instead-- then the unit get release to its respective pool.

WHAT IF....only 2 of the Welk resorts match up to the Hyatt level of quality and the remainder are dogs. What would be the impact to HRC if all those resorts are placed into HRC???

? High demand for the two, little demand for the others?

? High demand for original HRC resorts plus the 2 Welk by a much larger member pool?

? Low occupancy for the "other Welk resorts"?

? Financial implications of higher annual maintenance fees on former Welk owners?

WHAT IF

[/QUOTE

The different quality between different location exist in all timeshare system currently. The correction would be amount of points required to book it and would differ on season. Welk currently are doing it and Marriott adopted this approach when they roll out the Destimation Club.WHAT IF....only 2 of the Welk resorts match up to the Hyatt level of quality and the remainder are dogs. What would be the impact to HRC if all those resorts are placed into HRC???

? High demand for the two, little demand for the others?

? High demand for original HRC resorts plus the 2 Welk by a much larger member pool?

? Low occupancy for the "other Welk resorts"?

? Financial implications of higher annual maintenance fees on former Welk owners?

WHAT IF

The issue is Hyatt. When you look at the maintenance fee budget, there are numerous line items devoted to Hyatt Management (not resort specific management). The local board of directors has no control of those line items. My guess is that cost of that involvement will be considerably higher than the cost of Welk management. That cost structure spans both HPP and HRC. Get ready for a sticker shock....as to maintenance fees, I do not see how it would changes. Current maintenances fees for Welk is point based and is a function of underlying resort that the point own. It may even be decreased with better purchasing power. HPP trust point maintenance fees is the same as it is a function of the average cost per point. I do not see significant changes other than that the “build up unsold inventory “ would be harder to book for existing Welk Owner

WHAT IF....only 2 of the Welk resorts match up to the Hyatt level of quality and the remainder are dogs. What would be the impact to HRC if all those resorts are placed into HRC???

? High demand for the two, little demand for the others?

? High demand for original HRC resorts plus the 2 Welk by a much larger member pool?

? Low occupancy for the "other Welk resorts"?

? Financial implications of higher annual maintenance fees on former Welk owners?

WHAT IF

I am always upset that my underlying deeded week maintenance fees keep increasing every year in Hyatt and Marriott. But then compared to those Marriott DC trust point and Hyatt trust HPP point they are significantly lower per points. Then I look at the maintenance fees for Hyatt beaver creek or Aspen., I am happy I am able to trade there and not that maintenance fees. So it is all relative.The issue is Hyatt. When you look at the maintenance fee budget, there are numerous line items devoted to Hyatt Management (not resort specific management). The local board of directors has no control of those line items. My guess is that cost of that involvement will be considerably higher than the cost of Welk management. That cost structure spans both HPP and HRC. Get ready for a sticker shock.

I have only owned one week at Highlands Inn for three years and haven't stayed there. I've exchanged into other Hyatts and into Interval and I always thought that I would need to call Hyatt to release my points so that I could use them at another Hyatt. Is it the case that I can just book online and it will automatically release my points and complete the booking?

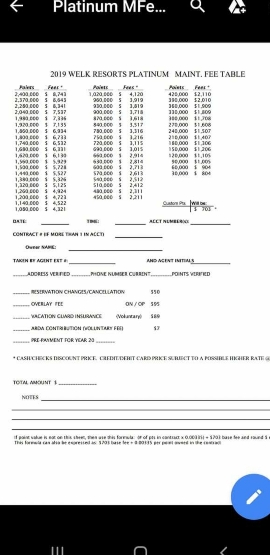

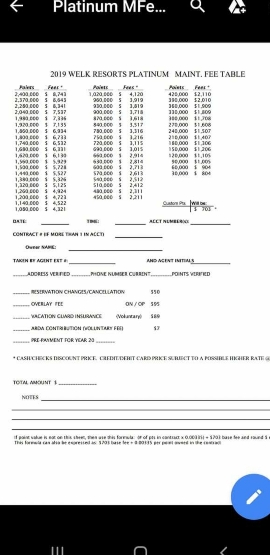

I listed the MF for 2019 in my post titled Welk in the other exchange systems description of Welk but I'll post it again.I am always upset that my underlying deeded week maintenance fees keep increasing every year in Hyatt and Marriott. But then compared to those Marriott DC trust point and Hyatt trust HPP point they are significantly lower per points. Then I look at the maintenance fees for Hyatt beaver creek or Aspen., I am happy I am able to trade there and not that maintenance fees. So it is all relative.

Currently maintenance fees for Welk look high already. Maybe Welk owners can comment of the maintenance fees required to book a 2 BR at various place. But my guess is that it is higher than what we Are paying and is more consistent with point base system

I'm not talking demand within the organization, but rather level of quality. Maybe a way to evaluate the two systems is to compare the resorts side-by-side. IMHO, I would think Branson and Escondido would be a stretch. Northstar would be a great match (still don't know why Hyatt sold interests to Welk).The fact that you are asking the question shows that you know little about the Welk resorts. From what I have seen, none of them have little demand, this year being the exception. And the current "availability" of resorts is somewhat misleading due to the amount of inventory that is owned by the developer that he can put into rental and exchange pools.

Re: maintenance fees. I really have no idea what Hyatt fees are. However, it is no less than what I am paying currently for Vistana.

Re: quality. Welk in general is pretty high quality; it just lack brand appeal. But from an overall resort experience, between the activities and amenities that exist on site, Welk overall seems to be a better value.

Thank you. It is interesting that it is not linear. Currently Hyatt HPP and Marriott trust point maintenance fees are simply per points. I saw a resale posting for Northstar week 51 3BR Currently listed on RedWeek The maintenance fees of that was around $6500. Unless I read it wrong, how does Welk subsidize that maintenances fees compared to your point cost for booking?.I listed the MF for 2019 in my post titled Welk in the other exchange systems description of Welk but I'll post it again.

420k points is what you need for ski season 2BR in Tahoe. So around $2300 now. However, that includes RCI Platinum membership, no parking fees, no cancellation fees, no booking fees no matter how many times we book, Guest certs used to be fee but now they're $50, no transfer fees even into the collection/affiliated resorts.

Sent from my SM-G892A using Tapatalk

I'm not 100% sure what you mean but the MF are set up as a $700ish base fee for all points accounts. Then $0.0033/point on top of that.Thank you. It is interesting that it is not linear. Currently Hyatt HPP and Marriott trust point maintenance fees are simply per points. I saw a resale posting for Northstar week 51 3BR Currently listed on RedWeek The maintenance fees of that was around $6500. Unless I read it wrong, how does Welk subsidize that maintenances fees compared to your point cost for booking?.

I'm not 100% sure what you mean but the MF are set up as a $700ish base fee for all points accounts. Then $0.0033/point on top of that.

Sent from my SM-G892A using Tapatalk

Regardless, since the maintenance of the underlying week 51 3BR Northstar is $6500, how many points does it cost to book that week. ---- I saw your point chart for Welk and it seem that point cost for that week is 5400 for 3BR. Since MF for that quantity of points is significantly lower than the MF of the underlying week, the owner of that week would likely try his/her best to rent in open market and would only deposit if they are not successful at last minute.

Thank you. It is interesting that it is not linear. Currently Hyatt HPP and Marriott trust point maintenance fees are simply per points. I saw a resale posting for Northstar week 51 3BR Currently listed on RedWeek The maintenance fees of that was around $6500. Unless I read it wrong, how does Welk subsidize that maintenances fees compared to your point cost for booking?.

It looks like owners at Northstar get 2 weeks of usage with that $6500 plus a midweek stay (1/20th share).From your post, 240,000 points has around $1500 MF. But 1M points MF is only $4100 and not $6000.

Regardless, since the maintenance of week 51 3BR Northstar is $6500, how many points does it cost to book that week>

You may want to post a separate thread. @Shankilicious @nuwermj @RunCat are knowledgeable about welk.I don't know as much as you folks here on TUG I admire your knowledge base. I am a Welk owner and I feel like I got gypped. I was hoping to share our situation and please ask for feedback because I am not sure I am seeing the big picture: my in-laws joined Welk in the 80’s. We grew up in and around Welk and inherited their 300k points three years ago because they both passed away. Then 2 years ago we spent only 2k to buy a 180k point account not realizing the distinction between the two types of ownership. The big one being the two owner base fees. The other one being the idea that those points had different status and were looked at differently. So just a year ago we paid 7K to add 60k points and blend everything to be 540 Priority Level Platinum owner. We haven’t even had the chance to experience the perks that came along with it nor have we had the chance to recoup by saving the base owner fee each year. These were the reasons we paid those fees. Does that make sense? That’s the part that is hard for me to judge.

The good thing is that it will be a couple years before the Hyatt/Welk merger gets a program that joins the two.I don't know as much as you folks here on TUG I admire your knowledge base. I am a Welk owner and I feel like I got gypped. I was hoping to share our situation and please ask for feedback because I am not sure I am seeing the big picture: my in-laws joined Welk in the 80’s. We grew up in and around Welk and inherited their 300k points three years ago because they both passed away. Then 2 years ago we spent only 2k to buy a 180k point account not realizing the distinction between the two types of ownership. The big one being the two owner base fees. The other one being the idea that those points had different status and were looked at differently. So just a year ago we paid 7K to add 60k points and blend everything to be 540 Priority Level Platinum owner. We haven’t even had the chance to experience the perks that came along with it nor have we had the chance to recoup by saving the base owner fee each year. These were the reasons we paid those fees. Does that make sense? That’s the part that is hard for me to judge.

It looks like owners at Northstar get 2 weeks of usage with that $6500 plus a midweek stay (1/20th share).

It looks like they get their fixed week (2950 points), a platinum week and 3300 points of floating time.

To turn it to Welk points that would be 480,000 for the christmas week + 480,000 for a summer week, and we'll say 240,000 for the half -week stay.

It looks like the maintenance fees would be $4,660 ($700 + 1,200,000 x .0033).

One thing to point out is that the cost for a 3 bedroom is a good value at the Welk Northstar (a 3 bedroom is comprised of a studio 120K and a 2 bedroom 420K) -- so you are saving 60K by getting the 3 bedroom.

Remember though that the Hyatt cost is closer to the cost that the points trust is paying in maintenance fees for the equivalent weeks (remember the Hyatt and Welk split shared costs). I would think the biggest difference would be in club dues (in this case 157 * 2.5 = $392.50 for Hyatt) vs Welk (it sounds like the Welk equivalent would be $700).

The cost to maintain Northstar gets offset by lower maintenance fee weeks within the Welk trust. If you only book Northstar, you would definitely maximize your value.