Bill It sounds like you should just stick with your last points: that is, stocks didn't work out for you, you were never comfortable with their volatility, you don't understand how markets work, and you are more comfortable with real estate - as opposed to making broad unsubstantiated claims that are just plain wrong.

There are a lot of ways to succeed financially and real estate is certainly one of them. We own/co-own ten doors ourselves. But we do understand stock and bond markets - I've been reading about them for forty years - and the bulk of our investments are in liquid markets. Very successfully I might add.

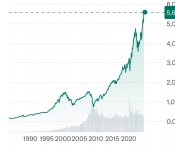

Yes stocks will go down someday. The Dow went down today! But over time they go up. Owning global business has been a winning strategy for hundreds of years and barring WW3 we'll continue to be a winning strategy for the next few hundred years.

Yes stocks will crash someday! I've invested through the 1987 Black Monday crash, the tech bubble and crash, the Great recession, and COVID. I haven't ever sold except to rebalance. I'm confident a future crash won't bother me because I have an asset allocation suitable for my risk tolerance and my need and ability to take risk.

If you do choose to educate yourself about financial markets, the Bogleheads website maintains a good reading list.