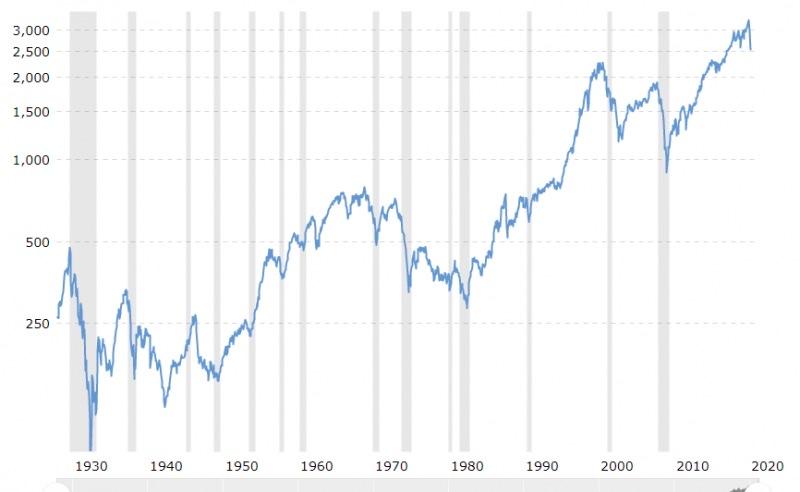

Actually the chart you showed makes the point with regard to secular bull and secular bear markets. Not to be confused with the commonly termed bull and bear markets that we hear on the news shows. A secular market analysis has to do with PE ratios over time. The average cycle is about 20 years on average but it can vary. Secular bear markets are characterized by volatility and by declining macro PE ratios during the time period - PE ratios start out very high and decline to lows during the defined time period. Secular bull markets are characterized by upward PE ratios from low high.

Let’s look at the chart you shared with this in mind:

From 1910-1929 - the roaring 20’s as they were known - secular bull market.

1930-1950 - secular bear market

1950-1965 - secular bull market

1965-1980 - secular bear market

1980-2000 - secular bull market

2000-2010 - secular bear market

2010-???? - secular bull market

The last couple of decades don’t fit the pattern - but then again we had a major financial crisis and with the massive bailout by the Fed and massive QE we artificially propped up the markets and have caused bubbles to form that are unprecedented in history. So the pattens may change as a result. Past performance does not always predict future performance.

That said, we are near all time high PE ratios prior to the start of this latest shock. Why do secular markets matter? Because many people don’t really have a 40+ year investment horizon. Many realistically have 20 good years for their investments. Say you did what you were told and exercised “buy and hold” primarily in stocks from 1965-1985 - what was your total return over that 20 year time period? Zero. Same with pretty much all of the secular bear market time periods listed above.

So while the street will say it’s best to always be invested, and they will say that historically the market returns 10% per annum over the long term, and technically that may be true, the data teaches us that the timing and duration of your investments as it relates to secular markets is very important. Especially if you have a limited duration during which your retirement savings is invested in the stock markets.

If you are investing at the start of a secular bull market - buy and hold is everyone’s friend and index funds work best. If you are investing at the start of a secular bear market then buy and hold doesn’t work and index funds do not work well. Zero returns is often the result during secular bear markets since PE ratios are declining during that period of time. Therefore capital preservation during secular bear markets is especially important.

How can we validate that this all has some truth to it? Look at what accredited investors can access. One of the major advantages of hedge funds is that, unlike most mutual funds, hedge funds can employ leverage, shorts, options, really anything, and can go to 100% cash without any oversight. Mutual funds always must have a certain amount of their capital invested and can only invest based on the fund charter. This is in part why the rich get richer and the poor stay poor. The rich have accredited investor status and literally have access to hedged investments that the vast majority of normal investors cannot ever use. So when normal investors are losing money in a secular bear market, hedge funds are making money. In this respect, at least based upon my experience - there are two Americas out there - especially when it comes to investments.

Sent from my iPhone using Tapatalk