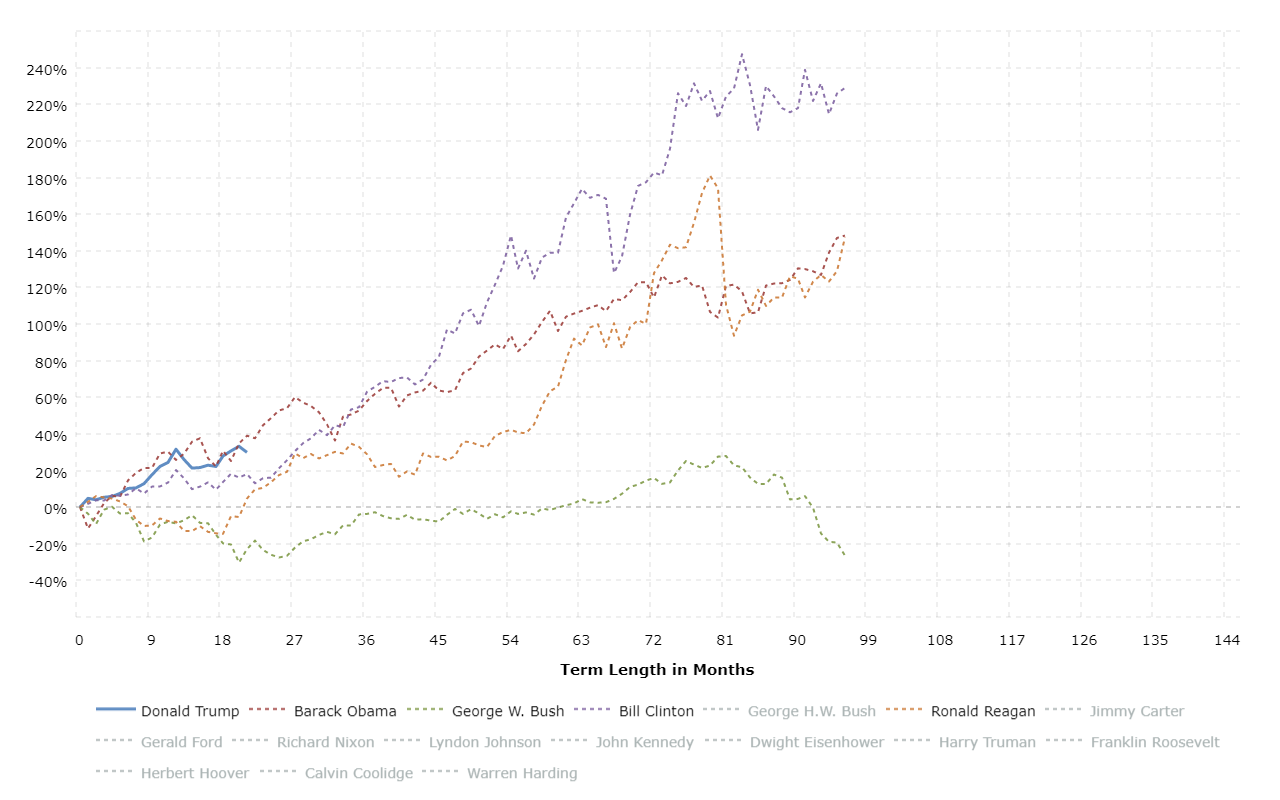

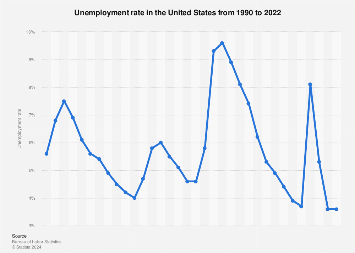

The Wall Street Journal says we just entered a new bull market! LOL It makes a good headline. Maybe people may read news like this and jump back in, making it a self fulfilling prophecy. Personally, I am least worried about the stock market and most worried about the unemployment rates, businesses going bankrupt and how so many people will be defaulting on rent, mortgages, etc. The complete shut down of the economy will cause a possible depression. The stock market will start coming back once the virus stabilizes and well before the worst is over. By 2009, the stock market was already climbing even though the worst of the Great Recession was not over for several years after that.

--------

Dow Escapes Bear Market With a 6% Rally

The blue-chip index is now up 20% from its low, qualifying as a new bull market

By Caitlin McCabe, Anna Hirtenstein and Chong Koh Ping

Updated March 26, 2020 5:31 pm ET

U.S. stocks soared Thursday as the government came closer to approving a $2 trillion stimulus package to combat the coronavirus pandemic, capping a three-day rally that has pushed the Dow Jones Industrial Average into a bull market.

The Dow industrials finished the day up 1351.62 points, or 6.4%, to close at 22,552.17. The jump ends an 11-trading day bear market for the index—the shortest in history for the Dow—which reached its bear-market low just three days ago.

The rapid plunge out of, and then back into, a bull market underscores just how volatile U.S. stocks have become as the coronavirus pandemic ripples through the economy. The Dow industrials are still down 21% for the year, despite also climbing 21% in the last three days—the largest three-day percentage gain for the index since 1931.....

Read more here:

The Dow industrials rose more than 1,300 points, putting it 20% above its recent low and back into bull-market territory, despite unemployment claims soaring in a fresh sign of the economic disruption caused by the coronavirus pandemic.

www.wsj.com