CO skier

TUG Member

- Joined

- Sep 18, 2012

- Messages

- 5,011

- Reaction score

- 3,349

"Sell now to protect your retirement and reinvest at much lower levels. " That is an important point that I included in my original post.Got it. I thought you were advocating to 'sell out of stocks and never return'.

I have three accounts. The bulk of my retirement savings is in a self-directed IRA rollover of various employer 401Ks over the years; a Roth IRA; a basic brokerage account. When the Nasdaq 100 crossed below the 10-day average on February 21, I sold them all at 3 p.m. Mountain Time, when it looked like it would close below the 10-day average. I invested 50% of the rollover IRA into QID at 15:42:03 for $19.9999/share.You can dollar cost average over two days? What is the frequency of buys when you do that? Can you cancel out of your remaining buys if things turn south (or north as the case may be). You must have been pretty confident of a continued drop.

On February 25 at 11:22:32, my QID limit order for the other 50% of the rollover account filled at $22.0999. I entered the order because it looked like there was legs to the downside. I was confident enough that the market was headed lower, but I know there are never guarantees.

I intended to buy more QID over the next and following day using the other two accounts, but the market moved too fast, and I did not want to chase it. They remained in cash the whole time.

The current market is waaaay overdue for a short-covering bounce, and especially from these support levels. Which is why I did not hesitate to sell into the oversold conditions of a one-day, 10% sell off (20% gain for me). Plus, a 39% gain in a few weeks is a once in a lifetime trade; it will only happen to the downside. I am a firm believer in the old Wall Street adage that, "Bulls make money, Bears make money; Pigs get slaughtered."So you do think the market could bounce back quickly.

A 10% bounce happened yesterday (Friday), but it looked like a hit job in the last hour from the Plunge Protection Team. I have no confidence in the sustainability. It looked like a gift to sell out for those who were burned by the Thursday sell off.

Bounce back to new highs? Not for years.

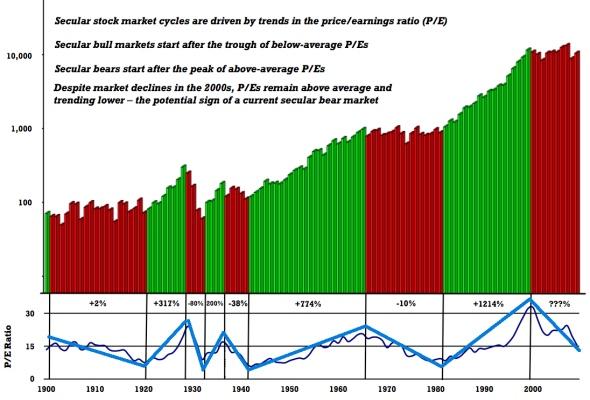

We are living through unprecedented times. There were no grocery store buying panics in the 2008 financial crisis. I think we will see in this current bear market, a 14% sell off in one day that triggers a second-in-the-day timeout for stock trading. With the news feed over this weekend, it may happen on Monday. The US government is step-wise shutting down the American economy. If the Mexico and Canadian borders close, that would also likely trigger a massive sell off. This is no time to have any money at risk to the long side in the stock market, especially considering how overpriced it STILL is. jmo, and that is how I am protecting my retirement.

The economic impact and financial panic will be 1,000 times worse than the Corona virus disease.