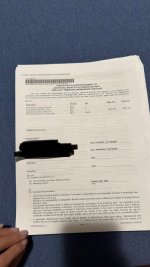

I believe i this is all i could find regarding payment and loan . Is anyone could help me translate this meaning to be easier english or any suggestions. Should i also terminate the loan ?

-

The TUGBBS forums are completely free and open to the public and exist as the absolute best place for owners to get help and advice about their timeshares for more than 30 years!

Join Tens of Thousands of other Owners just like you here to get any and all Timeshare questions answered 24 hours a day! -

TUG started 31 years ago in October 1993 as a group of regular Timeshare owners just like you!

Read about our 31st anniversary: Happy 31st Birthday TUG! -

TUG has a YouTube Channel to produce weekly short informative videos on popular Timeshare topics!

Free memberships for every 50 subscribers!

Visit TUG on Youtube! -

TUG has now saved timeshare owners more than $23,000,000 dollars just by finding us in time to rescind a new Timeshare purchase! A truly incredible milestone!

Read more here: TUG saves owners more than $23 Million dollars -

Wish you could meet up with other TUG members? Well look no further as this annual event has been going on for years in Orlando! How to Attend the TUG January Get-Together!

-

Sign up to get the TUG Newsletter for free!

Tens of thousands of subscribing owners! A weekly recap of the best Timeshare resort reviews and the most popular topics discussed by owners! -

Our official "end my sales presentation early" T-shirts are available again! Also come with the option for a free membership extension with purchase to offset the cost!

All T-shirt options here!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Please help [we bought] HGV and [we were scammed]

- Thread starter Maeris

- Start date

iftravel

TUG Member

- Joined

- Mar 29, 2024

- Messages

- 600

- Reaction score

- 167

- Resorts Owned

-

DVC - Hilton Head

The Colonies at Williamsburg

oh no think you signed a loan doc, and worse it's a loan from an affliated company of HGV. If it's from a thrid party bank, they are slightly on your side because they don't want you to default on the loan immediately (so they might let you cancel). if it's from an affiliated company of the developer, they don't care if you don't pay. it costs nothing to them anyway. Still try to contact them and cancel the loan before closing! if it's closed, it's done and effective as the first page says!

- Joined

- May 20, 2006

- Messages

- 50,977

- Reaction score

- 22,472

- Location

- NE Florida

- Resorts Owned

-

Marriott Grande Vista

Marriott Harbour Lake

Sheraton Vistana Villages

Club Wyndham CWA

That's my thoughts. I wouldn't think a developer would let you out the door without having everything signed that they need signed in order to fully consummate the transaction. Closing is really just the developer signing the deeded interest over to the buyer. I wouldn't expect the developer to be coming back to the buyer for more signatures at closing. That would torpedo a lot more deals than right to cancel does.would be curious to know how a letter stating you intend to "not follow through with closing" would work out even if it had not yet closed? I dont believe any additional communication or signatures are required for that vs what was already in the signed contract? Would the resort even act on such a letter or just keep on keepin on with completing the transaction per the signed contract?

suppose the actual date of closing would come up if it actually got to mediation or similar but id not expect something like that to get that far TBH.

now you have me curious as to the usual timeframe for resorts to "officially close" after the contract is signed at the sales presentation.

- Joined

- May 20, 2006

- Messages

- 50,977

- Reaction score

- 22,472

- Location

- NE Florida

- Resorts Owned

-

Marriott Grande Vista

Marriott Harbour Lake

Sheraton Vistana Villages

Club Wyndham CWA

It won't be from a third party bank. Timeshare developers mainly do developer/seller financing. In fact the note indicates that the creditor is US Collection Development LLC. AKA Diamond Resorts US Collection/Trust.oh no think you signed a loan doc, and worse it's a loan from an affliated company of HGV. If it's from a thrid party bank, they are slightly on your side because they don't want you to default on the loan immediately (so they might let you cancel). if it's from an affiliated company of the developer, they don't care if you don't pay. it costs nothing to them anyway. Still try to contact them and cancel the loan before closing! if it's closed, it's done and effective as the first page says!

Traveler518

newbie

- Joined

- Nov 15, 2024

- Messages

- 2

- Reaction score

- 0

You might be ok. You might be "closing" on December 8. If that is correct, you will not own the timeshare until then. I would send them a letter and tell them you are cancelling the contract.Hi , i really desperately need help, we bought a HGV vlub vacation in Vegas on october 24th we get lured into presentation. We get very tempted with all the promises. When we come back home , on november the 8th we just realize what we get our self into . Its far from what they promised. We miss the recession time which 5 day after the 24th of october which also they not mention when the sales rep selling us the product. Mind you we live in Canada. We don’t pay any installment yet we only put down payment as $1339 USD and we have loan for $12,000USD they give us until december the 8th for option to pay in full. We are really regretting what we get our self into . False promises , lack of resort time and option. We don’t know how to get out. On November 8th i send the email to all HGV email i could found for cancellation . No one is replying . Its extremely hard to get to phone with them. What are my options here. What happen if we just not paying and our timeshare goes to default or should i try to dispute our debt and send it to HGV US collection orlando office ? Should we pay all the loan and tranfer/transition and we will never use it what are the best options we have here ? I really need your advice please and thank you

14.2: if you do not close, they will keep all the money you gave them.

After the close, they can do a lot worse.

19. Address to send the notice that you are cancelling the contract.

You will have to pay $12,000 and then every year you will have to pay a maintenance fee. Some resorts are $2000 or more. There will be other expenses.

I suggest strongly that you invest in a lawyer in whatever state the closing is supposed to take place. Tell the lawyer that you did not understand what you were signing. It sounds as though your English is not too good and you are not familiar with US business practices. The people who sold this to you should have known that you did not understand this contract. The lawyer might be able to get the contract voided out because you did not understand it.

Meanwhile, you go to Google translate and translate the contract into your native language. You have to do a bit at a time. You still need a lawyer.

I'm guessing the lawyer will cost you $400 to $1200, but it will be worth it. It will save you probably $14,000 this year alone.

Good luck. I think you can fight this if you continue to claim that you did not understand the contract due to your language and the lack of familiarity with US business. You might lose the downpayment.

I did send letter of rescind to the address number 19 mentionas on the sec 8 mention i haven’t receive my point certificate yet so closing hasn’t happened yet . I’m okay of losing down payment . And i send letter to us collection and escrow company hoping for some luck. I really hope they cancle without a problem.You might be ok. You might be "closing" on December 8. If that is correct, you will not own the timeshare until then. I would send them a letter and tell them you are cancelling the contract.

14.2: if you do not close, they will keep all the money you gave them.

After the close, they can do a lot worse.

19. Address to send the notice that you are cancelling the contract.

You will have to pay $12,000 and then every year you will have to pay a maintenance fee. Some resorts are $2000 or more. There will be other expenses.

I suggest strongly that you invest in a lawyer in whatever state the closing is supposed to take place. Tell the lawyer that you did not understand what you were signing. It sounds as though your English is not too good and you are not familiar with US business practices. The people who sold this to you should have known that you did not understand this contract. The lawyer might be able to get the contract voided out because you did not understand it.

Meanwhile, you go to Google translate and translate the contract into your native language. You have to do a bit at a time. You still need a lawyer.

I'm guessing the lawyer will cost you $400 to $1200, but it will be worth it. It will save you probably $14,000 this year alone.

Good luck. I think you can fight this if you continue to claim that you did not understand the contract due to your language and the lack of familiarity with US business. You might lose the downpayment.

Traveler518

newbie

- Joined

- Nov 15, 2024

- Messages

- 2

- Reaction score

- 0

I strongly advise you to get a lawyer and send them all your paperwork.I did send letter of rescind to the address number 19 mentionas on the sec 8 mention i haven’t receive my point certificate yet so closing hasn’t happened yet . I’m okay of losing down payment . And i send letter to us collection and escrow company hoping for some luck. I really hope they cancle without a problem.

It’s not a defense that the OP was confused or speaks ESL. The lapse of the rescission period isn’t going to be voided. If the OP was given until 12/8/24 to decide whether to pay in full or use the loan, the escrow hasn’t closed yet. Notification to the seller that they are defaulting and forfeiting per 14.2 is significantly cheaper than hiring a lawyer in the venue where any litigation would be required. While I always believe it’s important to understand your legal rights, the OP is going to spend significantly more than the forfeiture to retain a lawyer. Folks don’t get contracts cancelled because they speak ESL. Nor does ignorance of the law work as a claim. If the contracting party is an adult of sound mind, they have capacity to contract.You might be ok. You might be "closing" on December 8. If that is correct, you will not own the timeshare until then. I would send them a letter and tell them you are cancelling the contract.

14.2: if you do not close, they will keep all the money you gave them.

After the close, they can do a lot worse.

19. Address to send the notice that you are cancelling the contract.

You will have to pay $12,000 and then every year you will have to pay a maintenance fee. Some resorts are $2000 or more. There will be other expenses.

I suggest strongly that you invest in a lawyer in whatever state the closing is supposed to take place. Tell the lawyer that you did not understand what you were signing. It sounds as though your English is not too good and you are not familiar with US business practices. The people who sold this to you should have known that you did not understand this contract. The lawyer might be able to get the contract voided out because you did not understand it.

Meanwhile, you go to Google translate and translate the contract into your native language. You have to do a bit at a time. You still need a lawyer.

I'm guessing the lawyer will cost you $400 to $1200, but it will be worth it. It will save you probably $14,000 this year alone.

Good luck. I think you can fight this if you continue to claim that you did not understand the contract due to your language and the lack of familiarity with US business. You might lose the downpayment.

Green Tree

TUG Member

- Joined

- Sep 12, 2023

- Messages

- 53

- Reaction score

- 12

- Resorts Owned

- grand islander

I was in your place last year. I did not realize I was scammed until the account was activated and found that I bought 4 nights (M-Thurs) instead of a whole week as promised. I was also promised that I could book at any Hilton resorts for a small amount if I bought a time share. I did finally get out of my contract (which I paid in full) and got fully refunded by Hilton although I passed the rescission period.

You need to review your contract carefully. If you bought a partial week, was it spelled out in the contract and the deed? Since it is a real estate transaction, the seller must specify very clearly in the contract. Hilton did not specify in my contract that I had bought M-Th and only mentioned "partial week" which was open for different interpretations.

Did you pay your deposit using a credit card? If the contract did not specify clearly the days of the week you bought, and you paid by credit card, please send a copy of the contract and deed to the credit company and file a dispute with your credit card company claiming fraud by Hilton and ask the credit card company to return the deposit to you. Normally the credit card company will be on your side if you have sufficient evidence.

I got lucky by discovering Hilton's loophole in the legal contract. Hilton first tried to intimidate me and then made me better offers. stand your ground. Contacting social media, squeaking wheels or stressing yourself do not help. Good luck.

You need to review your contract carefully. If you bought a partial week, was it spelled out in the contract and the deed? Since it is a real estate transaction, the seller must specify very clearly in the contract. Hilton did not specify in my contract that I had bought M-Th and only mentioned "partial week" which was open for different interpretations.

Did you pay your deposit using a credit card? If the contract did not specify clearly the days of the week you bought, and you paid by credit card, please send a copy of the contract and deed to the credit company and file a dispute with your credit card company claiming fraud by Hilton and ask the credit card company to return the deposit to you. Normally the credit card company will be on your side if you have sufficient evidence.

I got lucky by discovering Hilton's loophole in the legal contract. Hilton first tried to intimidate me and then made me better offers. stand your ground. Contacting social media, squeaking wheels or stressing yourself do not help. Good luck.

Of course the developer doesn't withhold documents that must be signed at the time of the sale in order for the transaction to close. Everything is signed, and then the statutory rescission period places a legal hold on the transaction and prohibits it from being legally closed. Once the rescission period is over, then there is a time frame between that and closing. The window is typically narrow.That's my thoughts. I wouldn't think a developer would let you out the door without having everything signed that they need signed in order to fully consummate the transaction. Closing is really just the developer signing the deeded interest over to the buyer. I wouldn't expect the developer to be coming back to the buyer for more signatures at closing. That would torpedo a lot more deals than right to cancel does.

It is during that time frame, even when the buyer has signed everything that is needed to close the deal, where the buyer revokes his or her authorization and notifies the seller and escrow that they do not agree to closing and are going to default in the purchase, thereby invoking the liquidated damages provision. Instructions to escrow to not fund the loan, do not record the deed, all the while communicating openly with the seller. It is called an anticipatory breach of contract. While that type of action in the normal business world will trigger litigation or performance demands, in the timeshare world there may very well be a provision in the documents that define the liquidated damages. When that is invoked, then that is the remedy.

Liquidated damages are as close to a self-help remedy as possible in the contract world. No litigation is required. Now, if the escrow and seller nevertheless went ahead with the closing, despite being on notice that the buyer revoked the authorization to close and was reneging on the deal, that conduct would be subject to dispute such that the legal remedy would be to void the transaction. But that would take filing suit (or an arbitration demand) by the aggrieved buyer.

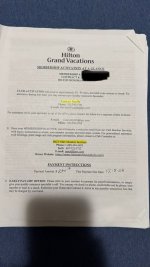

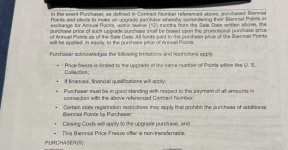

Hi we appreciate everyone thought we going to upload all the contract here if someone can help us finding the loophole will be so much appreciated as we speak english as second language and it so hard for us to understand this contract . We believe that property has no deed and only point base

Attachments

-

IMG_8638.jpeg125.2 KB · Views: 12

IMG_8638.jpeg125.2 KB · Views: 12 -

IMG_8639.jpeg296.8 KB · Views: 11

IMG_8639.jpeg296.8 KB · Views: 11 -

IMG_8640.jpeg226.8 KB · Views: 10

IMG_8640.jpeg226.8 KB · Views: 10 -

IMG_8641.jpeg220.7 KB · Views: 10

IMG_8641.jpeg220.7 KB · Views: 10 -

IMG_8642.jpeg217.8 KB · Views: 10

IMG_8642.jpeg217.8 KB · Views: 10 -

IMG_8643.jpeg138.9 KB · Views: 11

IMG_8643.jpeg138.9 KB · Views: 11 -

IMG_8644.jpeg152.7 KB · Views: 8

IMG_8644.jpeg152.7 KB · Views: 8 -

IMG_8645.jpeg160.5 KB · Views: 8

IMG_8645.jpeg160.5 KB · Views: 8 -

IMG_8646.jpeg139.4 KB · Views: 6

IMG_8646.jpeg139.4 KB · Views: 6 -

IMG_8647.jpeg139.4 KB · Views: 8

IMG_8647.jpeg139.4 KB · Views: 8 -

IMG_8648.jpeg129.7 KB · Views: 7

IMG_8648.jpeg129.7 KB · Views: 7 -

IMG_8649.jpeg253.9 KB · Views: 6

IMG_8649.jpeg253.9 KB · Views: 6 -

IMG_8650.jpeg122 KB · Views: 6

IMG_8650.jpeg122 KB · Views: 6 -

IMG_8651.jpeg258.7 KB · Views: 5

IMG_8651.jpeg258.7 KB · Views: 5 -

IMG_8654.jpeg132.4 KB · Views: 4

IMG_8654.jpeg132.4 KB · Views: 4 -

IMG_8655.jpeg107.7 KB · Views: 4

IMG_8655.jpeg107.7 KB · Views: 4 -

IMG_8656.jpeg263.5 KB · Views: 3

IMG_8656.jpeg263.5 KB · Views: 3 -

IMG_8657.jpeg268.4 KB · Views: 4

IMG_8657.jpeg268.4 KB · Views: 4 -

IMG_8658.jpeg139.3 KB · Views: 4

IMG_8658.jpeg139.3 KB · Views: 4 -

IMG_8659.jpeg125.6 KB · Views: 4

IMG_8659.jpeg125.6 KB · Views: 4 -

IMG_8660.jpeg148.3 KB · Views: 4

IMG_8660.jpeg148.3 KB · Views: 4 -

IMG_8661.jpeg165.5 KB · Views: 4

IMG_8661.jpeg165.5 KB · Views: 4 -

IMG_8662.jpeg185 KB · Views: 3

IMG_8662.jpeg185 KB · Views: 3 -

IMG_8663.jpeg177.9 KB · Views: 4

IMG_8663.jpeg177.9 KB · Views: 4 -

IMG_8664.jpeg150 KB · Views: 4

IMG_8664.jpeg150 KB · Views: 4 -

IMG_8665.jpeg182.8 KB · Views: 4

IMG_8665.jpeg182.8 KB · Views: 4 -

IMG_8666.jpeg185.7 KB · Views: 6

IMG_8666.jpeg185.7 KB · Views: 6 -

IMG_8667.jpeg168.3 KB · Views: 7

IMG_8667.jpeg168.3 KB · Views: 7 -

IMG_8668.jpeg134.9 KB · Views: 7

IMG_8668.jpeg134.9 KB · Views: 7 -

IMG_8669.jpeg113.2 KB · Views: 11

IMG_8669.jpeg113.2 KB · Views: 11

Also this one

Please help and let us know if anyone could find a loop hole on this contract that can help us out from this mess

Please help and let us know if anyone could find a loop hole on this contract that can help us out from this mess

Attachments

-

IMG_8670.jpeg142.1 KB · Views: 17

IMG_8670.jpeg142.1 KB · Views: 17 -

IMG_8671.jpeg112.7 KB · Views: 14

IMG_8671.jpeg112.7 KB · Views: 14 -

IMG_8672.jpeg114.9 KB · Views: 10

IMG_8672.jpeg114.9 KB · Views: 10 -

IMG_8673.jpeg146.5 KB · Views: 9

IMG_8673.jpeg146.5 KB · Views: 9 -

IMG_8674.jpeg77.6 KB · Views: 10

IMG_8674.jpeg77.6 KB · Views: 10 -

IMG_8675.jpeg126.2 KB · Views: 9

IMG_8675.jpeg126.2 KB · Views: 9 -

IMG_8676.jpeg158 KB · Views: 12

IMG_8676.jpeg158 KB · Views: 12 -

IMG_8677.jpeg83.7 KB · Views: 13

IMG_8677.jpeg83.7 KB · Views: 13 -

IMG_8678.jpeg127.7 KB · Views: 14

IMG_8678.jpeg127.7 KB · Views: 14 -

IMG_8679.jpeg98.6 KB · Views: 17

IMG_8679.jpeg98.6 KB · Views: 17

So i got on phone with HGV she said The Contract has already closed escrow and your account is active. Yes, you technically get Points in Jan of 2025 but the contract is legally binding once rescission passes. I guess at this point i can do is default and not making any payment. Hope they don’t sue me . Thank you for all suggestions

I'm guessing you spoke to someone in a call center. I wouldn't take what they say as the final word. Did you do what @LeslieDet suggested in comment #27 of this thread? I recommend doing that ASAP. The only thing you have to lose by following her recommendation is your time spent writing the letter (and postage?), but you have a LOT to gain if it works!So i got on phone with HGV she said The Contract has already closed escrow and your account is active. Yes, you technically get Points in Jan of 2025 but the contract is legally binding once rescission passes. I guess at this point i can do is default and not making any payment. Hope they don’t sue me . Thank you for all suggestions

I did i send writting letter and copy of contract to escrow and collection hoping for them to get back to me soonI'm guessing you spoke to someone in a call center. I wouldn't take what they say as the final word. Did you do what @LeslieDet suggested in comment #27 of this thread? I recommend doing that ASAP. The only thing you have to lose by following her recommendation is your time spent writing the letter (and postage?), but you have a LOT to gain if it works!

martininoon

newbie

- Joined

- Sep 25, 2024

- Messages

- 1

- Reaction score

- 0

Theoretically they can sue you, in reality, it seems virtually impossible given the difficulties involved and the small amount ($12,000). 15 years I asked a lawyer in Canada how much to sue for a clear-cut loan breach, he said $10,000. Probably $20,000 in legal fees today.If my account go to default is it will automatically closed and maintenance fee will be removed as well ? Is anyone know if Hilton can pursue a legal law suit against us if we live in Canada? Should I send letter to hgv us collection for defaulting loan or should I wait for the loan appear in our credit report and default from credit bureaus?

Possibly your credit report maybe affected. I think it's unlikely. But don't get too hung up on it- even with a default on your credit report, you could dispute it with credit bureaus, and even if it's not removed... so what? You get to live a few years with an incentive to avoid using credit... not a bad thing if you're perhaps prone to making impulse purchases.

IMO the only reason for you fulfill this purchase is for your own ethics. But since you feel you were lied to, then you shouldn't have any regret about reneging on the purchase.