TXTortoise

TUG Member

- Joined

- Sep 4, 2005

- Messages

- 1,488

- Reaction score

- 608

- Location

- San Antonio, TX

- Resorts Owned

- Maui OC Lahaina Fixed (3+)

Kauai Waiohai

Vail Streamside Birch

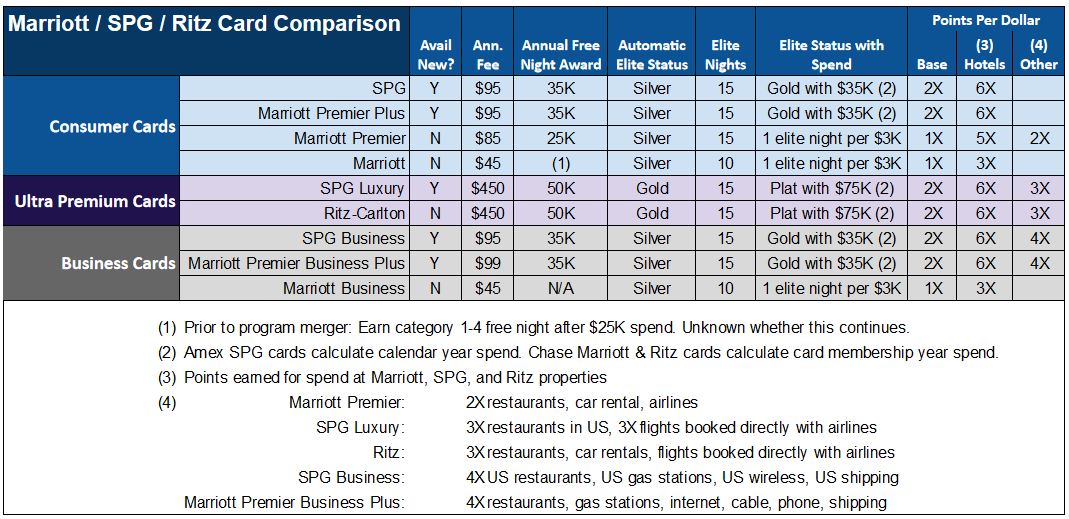

I know there are bits and pieces to this in various threads, but most talk about the new card.

I think both generate the same number of MR points, but before I push $10K+ to one or the other, I just needed a peer review. ;-)

FWIW, most of our spending is on the Amex SPG (or Chase SR).

I think both generate the same number of MR points, but before I push $10K+ to one or the other, I just needed a peer review. ;-)

FWIW, most of our spending is on the Amex SPG (or Chase SR).