-

The TUGBBS forums are completely free and open to the public and exist as the absolute best place for owners to get help and advice about their timeshares for more than 30 years!

Join Tens of Thousands of other Owners just like you here to get any and all Timeshare questions answered 24 hours a day! -

TUG started 31 years ago in October 1993 as a group of regular Timeshare owners just like you!

Read about our 31st anniversary: Happy 31st Birthday TUG! -

TUG has a YouTube Channel to produce weekly short informative videos on popular Timeshare topics!

Free memberships for every 50 subscribers!

Visit TUG on Youtube! -

TUG has now saved timeshare owners more than $24,000,000 dollars just by finding us in time to rescind a new Timeshare purchase! A truly incredible milestone!

Read more here: TUG saves owners more than $24 Million dollars -

Sign up to get the TUG Newsletter for free!

Tens of thousands of subscribing owners! A weekly recap of the best Timeshare resort reviews and the most popular topics discussed by owners! -

Our official "end my sales presentation early" T-shirts are available again! Also come with the option for a free membership extension with purchase to offset the cost!

All T-shirt options here!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Maui taxes [IMPORTANT - Proposal to RAISE Property Tax - AGAIN!]

- Thread starter alohakevin

- Start date

Wow. Page 61 is telling. And seeing it right there in black and white is plain ugly. When the economy took a nose dive, who made up the solid base of visitors to Maui? Who kept pumping dollars into local businesses? I guess we're the cash cow that keeps on giving.

Oh, gosh. Do I sound bitter?

Oh, gosh. Do I sound bitter?

- Joined

- Sep 11, 2006

- Messages

- 8,760

- Reaction score

- 8,090

At the rate the timeshare owners are being asked to pay real property taxes, they should not be subject to the TAT as well.

I noticed that they have also decided to stick it to their commercial property owners this year. Seriously?

I noticed that they have also decided to stick it to their commercial property owners this year. Seriously?

gregb

TUG Member

I can see now why Maui County is having trouble. Their proposed budget is over 600 pages!!!! In a quick scan, it seems that most of the pages are full of fluff and justification for the service costs.

The proposal does shift more of the property tax burden onto the Time Share industry. The proposed rate increase for Time Shares is the largest increase, double the other rate increases.

Greg

The proposal does shift more of the property tax burden onto the Time Share industry. The proposed rate increase for Time Shares is the largest increase, double the other rate increases.

Greg

Syed

TUG Member

- Joined

- Feb 13, 2008

- Messages

- 123

- Reaction score

- 79

- Location

- Maui,Hawaii

- Resorts Owned

- WKORV, WKORVN, Hyatt, Hilton and Club Donatello

I just spoke with the Maui County Council Budget and Finance Committee office and was told the County Council members are proposing to raise the timeshare property tax rate from 15.0 to 15.50/$1000, instead of the 16.15/$1000 the Mayor was seeking. The Mayor still has to sign it into law, which will take place next month. I will keep you posted.

Last edited:

gregb

TUG Member

I just spoke with the Maui County Council Budget and Finance Committee office and was told the County Council members are proposing to raise the timeshare property tax rate from 15.0 to 15.50/$1000, instead of the 16.15/$1000 the Mayor was seeking. The Mayor still has to sign it into law, which will take place next month. I will keep you posted.

Thanks for the Info Syed. Making a lot of noise does seem to get some attention. But I fear they will get it all eventually. The tactic seems to be to make an outlandish proposal, then, when everyone complains, reduce it. But somehow it always results in an increase.

Greg

Syed

TUG Member

- Joined

- Feb 13, 2008

- Messages

- 123

- Reaction score

- 79

- Location

- Maui,Hawaii

- Resorts Owned

- WKORV, WKORVN, Hyatt, Hilton and Club Donatello

Greg, I agree. Sad but true! We have to do this every year.

See the first link in my article below, which shows the Budget and Finance Committee recommendation at it May 7 meeting, for all Maui property owners.

http://advantagevacation.com/maui-budget-and-finance-committee-passes-tax-increase/

See the first link in my article below, which shows the Budget and Finance Committee recommendation at it May 7 meeting, for all Maui property owners.

http://advantagevacation.com/maui-budget-and-finance-committee-passes-tax-increase/

- Joined

- Jun 6, 2005

- Messages

- 35,172

- Reaction score

- 11,328

- Location

- The Centennial State

- Resorts Owned

- Wyndham; Disney OKW & SSR; Marriott's Willow Ridge, Shadow Ridge and Grand Chateau; Val Chatelle; Hono Koa OF (3); SBR(LOTS), SDO a few); WKORV-OFC-4 and Westin Desert Willow.

Thanks for letting us know, Syed. I cannot believe we have no voice in matters as they relate to Maui taxes on timeshares. We currently own 3 1/2 weeks on Maui, and I need to dump a few of those.

Slithern

newbie

It's sad it's gotten to this

I know it's all been said before but it's very disappointing that things have gotten to this point. I am an owner of an EOY OF at KORVN. I've loved Maui forever and have made a point to get there at least once a year and many years two or three times. My family spends when we get there, (car rentals, excursions, restaurants, diving etc.) You name it, we do it. I'm lucky to have been able to experience all Maui has to offer through the years. I often think and feel that i'm one of Maui's own even though deep down i do realize i'm not. That's why this is so sad. We've pretty much decided not to go to Maui much anymore if at all. We may use our EOY but no more in betweeners and more then likely we will be using our EOY for trades where our vacation dollars are truly wanted. I know i could just go there and not spend money while I'm there but that is not how i want to vacation and I am a very stubborn man. The email i received made it seem like i was being done a favor that the tax rate had only been raised 1/2 as much as they wanted. I'm not buying it and unfortunately, I won't be buying much else on Maui until things change.

Bill

I know it's all been said before but it's very disappointing that things have gotten to this point. I am an owner of an EOY OF at KORVN. I've loved Maui forever and have made a point to get there at least once a year and many years two or three times. My family spends when we get there, (car rentals, excursions, restaurants, diving etc.) You name it, we do it. I'm lucky to have been able to experience all Maui has to offer through the years. I often think and feel that i'm one of Maui's own even though deep down i do realize i'm not. That's why this is so sad. We've pretty much decided not to go to Maui much anymore if at all. We may use our EOY but no more in betweeners and more then likely we will be using our EOY for trades where our vacation dollars are truly wanted. I know i could just go there and not spend money while I'm there but that is not how i want to vacation and I am a very stubborn man. The email i received made it seem like i was being done a favor that the tax rate had only been raised 1/2 as much as they wanted. I'm not buying it and unfortunately, I won't be buying much else on Maui until things change.

Bill

- Joined

- Mar 10, 2007

- Messages

- 6,812

- Reaction score

- 331

- Location

- 'burbs of Cincinnati, OH

- Resorts Owned

- Used to own: WKORV-N; SVV - Bella

Bill, I know how you feel. We canceled our plans for January, which is a bummer because I really wanted to see the whales. But I work too hard for my money to visit a place where I'm treated like I'm a second class citizen, with an endless source of cash. Forcing one class of people who cannot vote to subsidize those who can is the coward's way of governing.

Please don't hold the people of Hawaii accountable for the idot's we elect. I live in Honolulu, so I'm not directly tied to Maui, but I do know that I vote (normally for the loser) and I can't believe some of the dumb cr*p that comes out of our elected officials mouths. There are tons of local business owners who need your support. I believe some of them like Sid even testified to the board that they need the time share owners. I know prices are rising, and if you can't afford to come that's definately understandable, but please don't stay away out of spite. You really end up only hurting yourself, where else can you experience what Hawaii has to offer.

LisaH

TUG Lifetime Member

slum808, just curious: how is the tax situation on Oahu (and Kauai)? Is this unique to just the county of Maui? Thank god I sold my SOK week two years ago...

I actually don't own in Hawaii, its to expensive  . I'll have to do some research on that one. I've heard that the state previously warned the Maui council that they're going down a slippery slope.

. I'll have to do some research on that one. I've heard that the state previously warned the Maui council that they're going down a slippery slope.

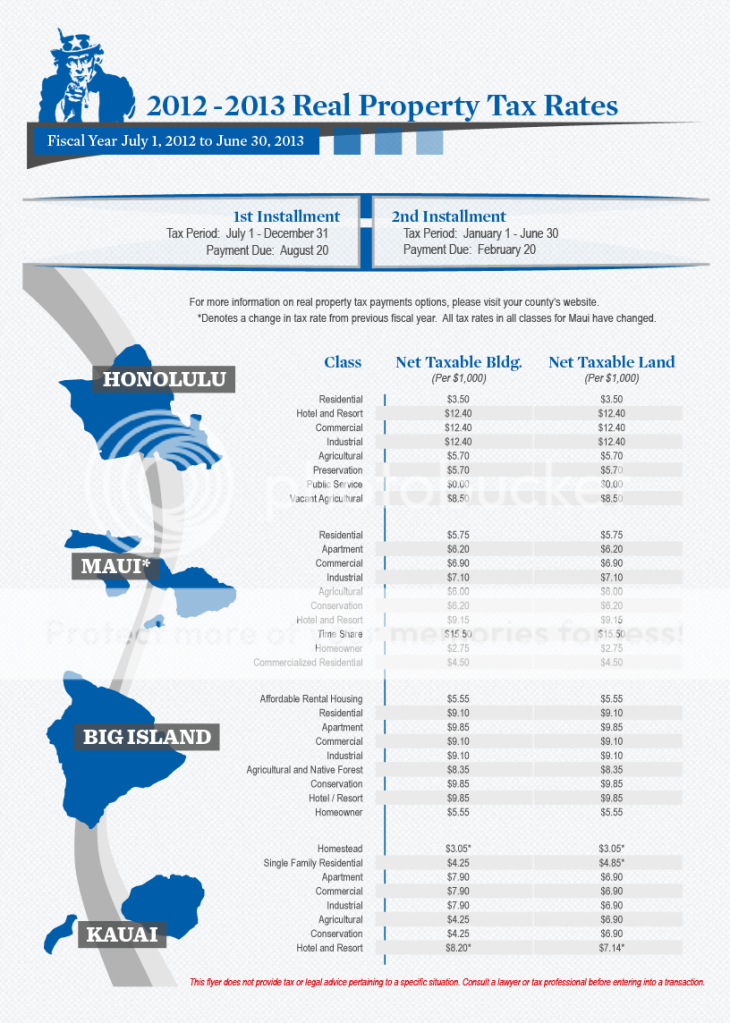

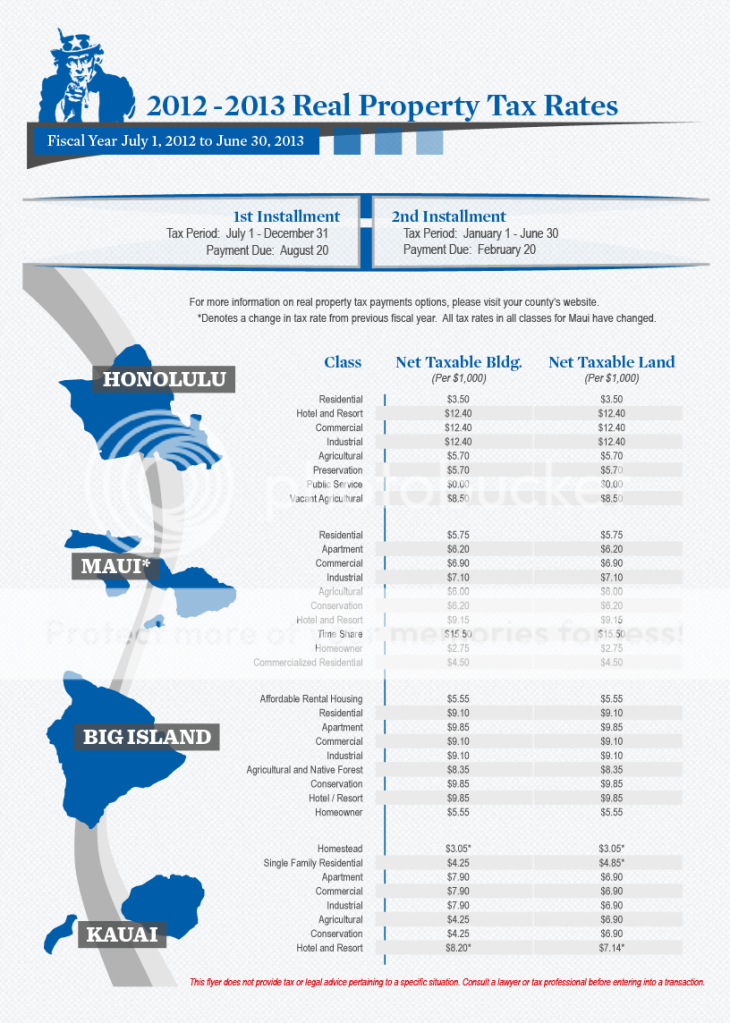

Okay found some info. According to the link below from the title guarantee website (reputable company) only Maui county has a timeshare classification. You can see the different rates per $1000 of assessed value. http://www.topproducerwebsite.com/users/19047/downloads/Property Tax Rates 10-11.pdf

I think to understand what the maui council is trying to do, you have to look many years back. Prior to the internet boom, maui residences were priced very moderatly. With the influx of investment dollars in second/vacation homes property values skyrocketed. I believe the Maui concile is trying to protect the local homeowner from what is percieved as outside forces manipulating the market. They didn't want residents property taxes to double just because someone is willing to buy the house next door for twice the money. Unfortunatly like all local governments, they got used to the excess and now that times are tough they're looking for money. Unfortunatly for timeshare owners they're an easy target. TS owners are perceived to have lots of money. So from a politicians eyes, who are they going to raise taxes on, the local residents who are already struggling in the ressesion, or the rich people who don't vote. Look at the feds, isn't this exactly what they want to do. I'll stop there before it gets to political.

My suggestoin, sell Maui buy Oahu. We'd love to have you come every year.

Okay found some info. According to the link below from the title guarantee website (reputable company) only Maui county has a timeshare classification. You can see the different rates per $1000 of assessed value. http://www.topproducerwebsite.com/users/19047/downloads/Property Tax Rates 10-11.pdf

I think to understand what the maui council is trying to do, you have to look many years back. Prior to the internet boom, maui residences were priced very moderatly. With the influx of investment dollars in second/vacation homes property values skyrocketed. I believe the Maui concile is trying to protect the local homeowner from what is percieved as outside forces manipulating the market. They didn't want residents property taxes to double just because someone is willing to buy the house next door for twice the money. Unfortunatly like all local governments, they got used to the excess and now that times are tough they're looking for money. Unfortunatly for timeshare owners they're an easy target. TS owners are perceived to have lots of money. So from a politicians eyes, who are they going to raise taxes on, the local residents who are already struggling in the ressesion, or the rich people who don't vote. Look at the feds, isn't this exactly what they want to do. I'll stop there before it gets to political.

My suggestoin, sell Maui buy Oahu. We'd love to have you come every year.

Last edited:

- Joined

- Mar 14, 2008

- Messages

- 1,256

- Reaction score

- 6

- Location

- Solon, OH (for love not the weather)

- Resorts Owned

- WSJ, HRA, WKORV, WMH, SBP, WLR

Email from SVO 16 May 2012

I'm surprised no one has posted this yet (for those who aren't owners):

May 2012

Dear Ocean Resort Villas Owner,

We recently informed you of the proposal by Maui County Mayor, Alan Arakawa, to increase the property tax rate paid by timeshare owners. The Mayor's proposed tax increase represented a 7.7% increase to the timeshare tax rate - bringing the overall rate from the current $15.00 per thousand of assessed value to a proposed $16.15.

On April 11, 2012, over 70 citizens and representatives affiliated with the timeshare industry attended the West Maui Hearing. Almost all of these attendees were there on behalf of the Ka'anapali Ocean Resort Villas, including your board members. Attendees also included employees, vendors and other supporters. Written and oral testimony was submitted opposing any tax increase in the timeshare rate.

On May 1, the Maui County Council Budget and Finance Committee voted to increase the timeshare property tax rate, but at a lower amount of 50 cents. This proposal will raise the timeshare rate from $15.00 per thousand of assessed value to $15.50, representing a 3.3% increase in the tax rate. A final vote on the tax rate will be held May 23, 2012, and the 50 cent increase is expected to be approved. The current year's reduction of 6% in assessed values, taxed at a rate of $15.50, will result in an overall decrease of approximately 3%; therefore, no adverse impact to owners.

Property taxes account for approximately 16% of the annual maintenance fee. Obviously your board continues to be concerned with the very high timeshare tax rate. This matter and appropriate next steps will be discussed at an upcoming meeting of your Vacation Owners Board.

To receive additional updates about this matter, you may visit the ARDA-ROC website at: http://www.ardaroc.org/roc/legislative-issues/issues.aspx?id=3568

Thank you for your support.

This email was sent by SVO Management, Inc. You've received this email as a convenience in the general course of communication regarding your ownership.

To ensure you receive your SVO Management, Inc. emails, please add svomanagement@svomanagementinc.com to your address book.

Please do not reply. You may email your board at kaanapali@myassociationdirect.com.

SVO Management, Inc.

9002 San Marco Court,

Orlando, FL 32819

CID 1898

I'm surprised no one has posted this yet (for those who aren't owners):

May 2012

Dear Ocean Resort Villas Owner,

We recently informed you of the proposal by Maui County Mayor, Alan Arakawa, to increase the property tax rate paid by timeshare owners. The Mayor's proposed tax increase represented a 7.7% increase to the timeshare tax rate - bringing the overall rate from the current $15.00 per thousand of assessed value to a proposed $16.15.

On April 11, 2012, over 70 citizens and representatives affiliated with the timeshare industry attended the West Maui Hearing. Almost all of these attendees were there on behalf of the Ka'anapali Ocean Resort Villas, including your board members. Attendees also included employees, vendors and other supporters. Written and oral testimony was submitted opposing any tax increase in the timeshare rate.

On May 1, the Maui County Council Budget and Finance Committee voted to increase the timeshare property tax rate, but at a lower amount of 50 cents. This proposal will raise the timeshare rate from $15.00 per thousand of assessed value to $15.50, representing a 3.3% increase in the tax rate. A final vote on the tax rate will be held May 23, 2012, and the 50 cent increase is expected to be approved. The current year's reduction of 6% in assessed values, taxed at a rate of $15.50, will result in an overall decrease of approximately 3%; therefore, no adverse impact to owners.

Property taxes account for approximately 16% of the annual maintenance fee. Obviously your board continues to be concerned with the very high timeshare tax rate. This matter and appropriate next steps will be discussed at an upcoming meeting of your Vacation Owners Board.

To receive additional updates about this matter, you may visit the ARDA-ROC website at: http://www.ardaroc.org/roc/legislative-issues/issues.aspx?id=3568

Thank you for your support.

This email was sent by SVO Management, Inc. You've received this email as a convenience in the general course of communication regarding your ownership.

To ensure you receive your SVO Management, Inc. emails, please add svomanagement@svomanagementinc.com to your address book.

Please do not reply. You may email your board at kaanapali@myassociationdirect.com.

SVO Management, Inc.

9002 San Marco Court,

Orlando, FL 32819

CID 1898

Tia

TUG Member

- Joined

- Jun 6, 2005

- Messages

- 3,525

- Reaction score

- 606

Refreshing to read as own a Wyndham resort in USVI and the board there is saying it's the individual ts owners responsibility on ts weeks units as the USVI has been trying to raise our taxes also........

I'm surprised no one has posted this yet (for those who aren't owners):

May 2012

Dear Ocean Resort Villas Owner,

We recently informed you of the proposal by Maui County Mayor, Alan Arakawa, to increase the property tax rate paid by timeshare owners. The Mayor's proposed tax increase represented a 7.7% increase to the timeshare tax rate - bringing the overall rate from the current $15.00 per thousand of assessed value to a proposed $16.15.

clip....clip

Property taxes account for approximately 16% of the annual maintenance fee. Obviously your board continues to be concerned with the very high timeshare tax rate. This matter and appropriate next steps will be discussed at an upcoming meeting of your Vacation Owners Board.

To receive additional updates about this matter, you may visit the ARDA-ROC website at: http://www.ardaroc.org/roc/legislative-issues/issues.aspx?id=3568

Thank you for your support.

This email was sent by SVO Management, Inc. You've received this email as a convenience in the general course of communication regarding your ownership.

To ensure you receive your SVO Management, Inc. emails, please add svomanagement@svomanagementinc.com to your address book.

Please do not reply. You may email your board at kaanapali@myassociationdirect.com.

SVO Management, Inc.

9002 San Marco Court,

Orlando, FL 32819

CID 1898

- Joined

- Jun 6, 2005

- Messages

- 35,172

- Reaction score

- 11,328

- Location

- The Centennial State

- Resorts Owned

- Wyndham; Disney OKW & SSR; Marriott's Willow Ridge, Shadow Ridge and Grand Chateau; Val Chatelle; Hono Koa OF (3); SBR(LOTS), SDO a few); WKORV-OFC-4 and Westin Desert Willow.

Okay found some info. According to the link below from the title guarantee website (reputable company) only Maui county has a timeshare classification. You can see the different rates per $1000 of assessed value. http://www.topproducerwebsite.com/us...es 10-11.pdf

Great chart. Really shows the disparity between property tax rates. I noticed Oahu had homeowner and non-homeowner. How does one bill property taxes to a non-homeowner?

Twinkstarr

TUG Member

Great chart. Really shows the disparity between property tax rates. I noticed Oahu had homeowner and non-homeowner. How does one bill property taxes to a non-homeowner?

I know Michigan has different property tax rates for primary residence and vacation/rental properties. From doing some research, in Charlevoix county the difference in property tax on a $225,000 condo to use for a vacations/rental was $3500 per year above what someone who uses it as a primary residence.

Now I am not sure how MI determines "primary" residency, but on the flip side I know Ohio is aggressive with property owners who claim another state as primary residency. My one aunt's brother would have to document how many days in spent at his house in OH. Finally sold the place as every year he would get audited by the state trying to collect Ohio income taxes.

Great chart. Really shows the disparity between property tax rates. I noticed Oahu had homeowner and non-homeowner. How does one bill property taxes to a non-homeowner?

It's worded weird, but what they mean is owner occupied vs non-owner occupied e.g. rental property.

Here's an updated chart for real property taxes on the different Hawaiian islands (from www.tradewindstribune.com )

- Joined

- Mar 10, 2007

- Messages

- 6,812

- Reaction score

- 331

- Location

- 'burbs of Cincinnati, OH

- Resorts Owned

- Used to own: WKORV-N; SVV - Bella

Not a big surprise, but the chart shows that we timeshare owners are subsidizing the residents quite a bit. That's what happens when you have taxation without representation, and a Council who has no courage.

- Joined

- Mar 10, 2007

- Messages

- 6,812

- Reaction score

- 331

- Location

- 'burbs of Cincinnati, OH

- Resorts Owned

- Used to own: WKORV-N; SVV - Bella

Looks like Maui is the only one with a Timeshare category?

I believe they are the only tax authority in the country that has a separate timeshare category.

- Joined

- Jun 7, 2005

- Messages

- 15,069

- Reaction score

- 6,190

- Location

- Los Angeles

- Resorts Owned

- Westin Kierland

Sheraton Desert Oasis

I believe they are the only tax authority in the country that has a separate timeshare category.

Wow, that's just absurd. While I'm happy trading into Hawaii, I have absolutely no intention of owning a timeshare there.

DavidnRobin

TUG Member

- Joined

- Dec 20, 2005

- Messages

- 11,910

- Reaction score

- 2,303

- Location

- San Francisco Bay Area

- Resorts Owned

- WKORV OFD (Maui)

WPORV (Kauai)

WSJ-VGV (St. John)

WKV (Scottsdale)

I believe they are the only tax authority in the country that has a separate timeshare category.

I can't believe it is even legal...

I can't believe it is even legal...

David, ... The legal standard is that the classification has no possible rational basis underlying it. The presumption is that the taxing officials acted correctly. The burden of proving no rational basis is on the taxpayer.

Taxpayers rarely win these classification arguments in court because the doctrine of necessity (we need the money) usually takes precedence. Trust me. I do this for a living.

http://jurist.org/paperchase/2012/06/supreme-court-rules-on-equal-protection-in-taxation.php

Salty

Last edited: