Hope someone can advise....I have previously posted re management fees and got some great support and advice from TUG folks. I live in the UK, have a timeshare at Cliffs At Peace Canyon (no mortgage and trying to give it away here on TUG) and have been in communication with resort for many months about deedback which they just will not consider unless I can prove hardship or medical reasons for wanting to deedback property. We have provided some info but the company does not seem to appreciate the differences between UK and USA systems or they are just not interested in doing so to no avail.

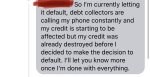

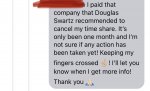

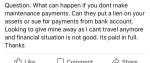

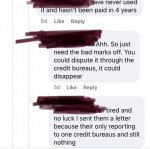

You will all be aware that due to Covid restrictions, there are very few places on the entire planet that people in the UK can travel to so we have not been able to use / exchange. I have not paid my management fees this year (although would do so if someone wanted to take timeshare and give them the 90K RCI points that are languishing in my account too) and have approached resort about a reduction in same but to no avail. This morning I received a letter from Aspen National Collections advising that if I do not pay management fees + $217 'fees' (not sure what this is), I will be reported to a debt collection agency. Any advice on what I should do would be gratefully received.

I have been advised to ignore the letter as it is unlikely that I could be pursued because I live in the UK. However, this is a great worry for me hence posting here.

You will all be aware that due to Covid restrictions, there are very few places on the entire planet that people in the UK can travel to so we have not been able to use / exchange. I have not paid my management fees this year (although would do so if someone wanted to take timeshare and give them the 90K RCI points that are languishing in my account too) and have approached resort about a reduction in same but to no avail. This morning I received a letter from Aspen National Collections advising that if I do not pay management fees + $217 'fees' (not sure what this is), I will be reported to a debt collection agency. Any advice on what I should do would be gratefully received.

I have been advised to ignore the letter as it is unlikely that I could be pursued because I live in the UK. However, this is a great worry for me hence posting here.