My gospel quartet occasionally gets paid. I wonder if that would meet the requirement?

You need to have some type of business. See info below.

How to Apply for a Business Credit Card

When applying for a business card, it’s important to understand how to fill out the actual application, as it’ll differ from a personal application.

Most of it will be pretty straightforward, but there are a few parts that might be a touch confusing.

The most important thing is to not make it too complicated. You don’t have to make your business look bigger, better, or more profitable than it is.

Just be honest on the application.

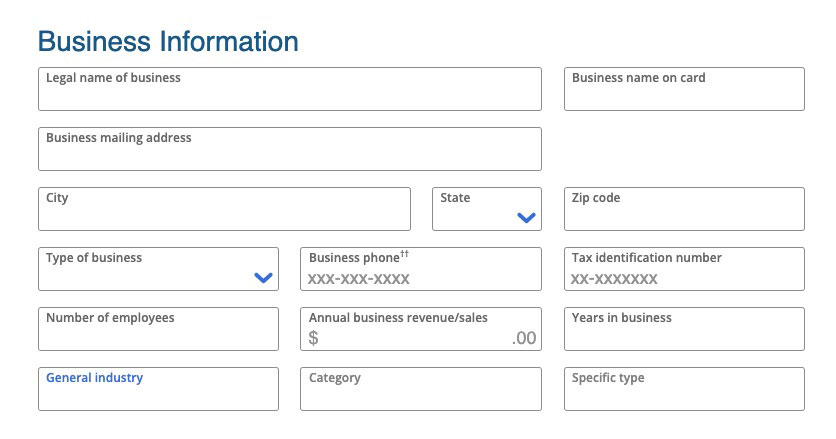

While each bank will have slightly different questions, let’s look at how to fill out a Chase business credit card application. Here’s what to put for each box on the application:

- Legal name of business: Put your own name.

- Business name on card: Again, your name is fine.

- Business mailing address: Use your home address (unless you have a separate business address).

- Type of business: Select Sole Proprietor

- Tax identification number: Use your social security number.

- Number of employees: For most people, this will be 0, unless your business actually has employees. Note that contractors do not count as employees, so don’t count freelancers you hired on sites like Upwork or Fiverr.

- Years in business: List the amount of time you’ve done whatever your business activity is.

- General industry, Category, and Specific type: Select the options that best describe your business. Don’t worry if your business doesn’t fit perfectly in the options the bank gives you.

- Annual revenue: Give your best guess if you’re not exactly sure. If you’re a start-up, you can put 0 in here. You’ll almost assuredly have to explain it later in a phone call, but that’s fine. We’ll explore that in the next section.

The information above is intended for people who, like my mom, don’t have a registered business.

Of course, if you have a registered business (such as an LLC or corporation), you can use that information.

How to Use the Business Card Reconsideration Line to Get Approved Faster

Don’t get frustrated…you’ll have that business card in no time by calling the reconsideration line!

First off, realize that this

DOES NOT MEAN YOU ARE DENIED!

Every single person I know, myself included, who has applied as a sole proprietor has gotten this message.

If you want to speed up the process, call up the business reconsideration line.

Waiting for a letter to tell you if you are approved or not can take up to a month, and oftentimes, you’ll be denied because the card issuer couldn’t verify your business.

Instead,

take 5 minutes and call the reconsideration line. You can call anytime, even the same day you applied, and will usually get approved immediately.

When you call the reconsideration line, simply tell the customer service rep that you applied for the card and would like to check on your application status.

They will then ask you a few basic questions about your business, such as:

- What is your business? What do you do?

- How long have you been in business?

- How much revenue did you make in the past year? How much of that was profit?

- How much revenue do you plan on making this year? Why do you think you’ll make that amount?

There may be some other, more specific questions about your business, so the best advice I can give you is to

take a few minutes and be prepared.

But don’t worry, this isn’t the Spanish Inquisition.

The person on the other end of the line just wants more information about your business.

It’s best to be as honest and personable as possible.

Don’t be nervous; you have an actual business!

I can’t begin to tell you how many people have told me they think they are doing something “wrong.”

I believe it comes from the idea that we that a “business” has to be a huge entity employing thousands of people.

The sooner you get past that false ideology and realize that a business is ANYTHING (big or small) that someone does to make money, you’ll understand that you have as much right to a business card as Bill Gates or Mark Zuckerberg. (Although you’ll probably be given a much smaller line of credit!)