-

TUG has a YouTube Channel to produce weekly short informative videos on popular Timeshare topics!

All subscribers auto-entered to win all free TUG membership giveaways!

Visit TUG on Youtube! -

TUG has now saved timeshare owners more than $24,000,000 dollars just by finding us in time to rescind a new Timeshare purchase! A truly incredible milestone!

Read more here: TUG saves owners more than $24 Million dollars -

Sign up to get the TUG Newsletter for free!

Tens of thousands of subscribing owners! A weekly recap of the best Timeshare resort reviews and the most popular topics discussed by owners! -

Our official "end my sales presentation early" T-shirts are available again! Also come with the option for a free membership extension with purchase to offset the cost!

All T-shirt options here!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Nice little comparison chart of other points based systems to DRI

- Thread starter TUGBrian

- Start date

- Joined

- Dec 19, 2008

- Messages

- 16,455

- Reaction score

- 5,011

- Location

- Maryland

- Resorts Owned

- A few in S and VA, a single resort in NC, MD, PA, and UT, plus Jamaica and the Bahamas

I think the chart is giving an idea of how many points it takes to reserve an average (not super high or super low end) 2 bedroom unit within each system and the average MF's for that number of points.

DRI annual fees in my opinion are to high.

- Joined

- Dec 19, 2008

- Messages

- 16,455

- Reaction score

- 5,011

- Location

- Maryland

- Resorts Owned

- A few in S and VA, a single resort in NC, MD, PA, and UT, plus Jamaica and the Bahamas

And unlike the other systems, DRI also adds either resort fees or a la carte fees for things like parking, internet and mini golf to exchangers when the other systems at comparative resorts in the same area include those items to both owners and exchangers.

VegasBella

TUG Member

- Joined

- Mar 7, 2013

- Messages

- 3,345

- Reaction score

- 1,064

- Location

- Vegas

- Resorts Owned

- Carlsbad Inn

Avenue Plaza

Riviera Beach & Spa

Aquamarine Villas

I wonder how accurate that is. I don't have DRI points but I own at a DRI managed resort. I own a 2 bedroom that's probably better than "average" yet my MF are way less. I pay about $700 or so per week of use.

ConejoRed

TUG Member

- Joined

- Jul 2, 2011

- Messages

- 315

- Reaction score

- 99

- Resorts Owned

- HGVC Craigendarroch Lodges, HGVC Bay Club, HGVC GP MarBrisa, Westin St. John, Westin Ka’anapali Ocean Villas,

HGVC MAX, Worldmark, Wyndham CWA

Makes the $806 I just pre-paid for 2017 - 7,000 points (2 Bedroom Platinum) in the HGVC system downright cheap. I did take advantage of the current GBP exchange rate and prepay the 2017 (last year is was around $940, but still much cheaper than all of these). I gave away a Sedona Los Abrigados IXL unit I had owned just as DRI took over the resort and am so glad I did now!

Would be interesting to also the other name brands to this list (HGVC, Marriott, Sheraton etc.) as well.

Would be interesting to also the other name brands to this list (HGVC, Marriott, Sheraton etc.) as well.

Last edited:

- Joined

- Dec 19, 2008

- Messages

- 16,455

- Reaction score

- 5,011

- Location

- Maryland

- Resorts Owned

- A few in S and VA, a single resort in NC, MD, PA, and UT, plus Jamaica and the Bahamas

I wonder how accurate that is. I don't have DRI points but I own at a DRI managed resort. I own a 2 bedroom that's probably better than "average" yet my MF are way less. I pay about $700 or so per week of use.

When you own deeded week you usually pay the same high or low season. With points at that same resort a DRI point owner might pay $500 to stay off season but pay $1600 in points to stay during high season. In addition to paying the average cost for mid season at all the resorts in the various trusts, points owners pay a couple hundred in addition to MF for the management of that trust plus another fee which may also be in the hundreds to belong to "The Club" which gives them access to resorts in the other trusts.

Even with all that said, at $700 for the deeded week, I think you are paying below the average MF for a 2 br deeded DRI week.

VegasBella

TUG Member

- Joined

- Mar 7, 2013

- Messages

- 3,345

- Reaction score

- 1,064

- Location

- Vegas

- Resorts Owned

- Carlsbad Inn

Avenue Plaza

Riviera Beach & Spa

Aquamarine Villas

I actually just double-checked and we are paying $800. Plus there's a special assessment type of fee so it's actually $1000. When DRI took over they did increase our fees. They've been going up little by little each year.

youppi

TUG Member

This was posted on one of the DRI facebook pages awahile ago, I found it interesting at least!

IMO, You should asked him the detail before posting it to avoid speculation on how he did that. I have some detail about how he did it but I will not post it without his permission because he didn't post the detail on FB but only sent it to me and may be others.

nuwermj

TUG Member

Thanks Brian for posting my comparison, and thanks everyone for discussing it. The point ratios among the developers are only estimates, and improvements can always be made.

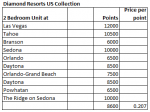

For the estimates in the posted tables, I took a sample of resorts from the Diamond network and matched them with resorts in the other network. I tried to control for number of bedrooms (2-br whenever possible), location, the quality of the resort, and the week (I looked for high demand, but not peak times). I then used the average of these samples to estimate the ratios.

The data for the Wyndham comparisons looks like this (DRI points first, Wyndham second):

Las Vegas: 12,000 || 203,000

Tahoe: 10,500 || 238,000

Branson: 6,000 || 164,500

Sedona: 10,000 || 189,000

Orlando: 6,500 || 175,000

Daytona: 8,500 || 203,000

Average: 8,917 || 195,417

For the estimates in the posted tables, I took a sample of resorts from the Diamond network and matched them with resorts in the other network. I tried to control for number of bedrooms (2-br whenever possible), location, the quality of the resort, and the week (I looked for high demand, but not peak times). I then used the average of these samples to estimate the ratios.

The data for the Wyndham comparisons looks like this (DRI points first, Wyndham second):

Las Vegas: 12,000 || 203,000

Tahoe: 10,500 || 238,000

Branson: 6,000 || 164,500

Sedona: 10,000 || 189,000

Orlando: 6,500 || 175,000

Daytona: 8,500 || 203,000

Average: 8,917 || 195,417

nuwermj

TUG Member

Would be interesting to also the other name brands to this list (HGVC, Marriott, Sheraton etc.) as well.

I've done some work with Marriott Destination Points. I get a point ratio of 2.58 Marriott to 1 Diamond. Thus 15,000 Diamond point equates roughly 5,806 Marriott points. The fees for Diamond would be about $2,750; the fees for Marriott are $3,080 (assumes $0.53 per point).

Last edited:

nuwermj

TUG Member

IMO, You should asked him the detail before posting it to avoid speculation on how he did that. I have some detail about how he did it but I will not post it without his permission because he didn't post the detail on FB but only sent it to me and may be others.

Thanks for this consideration. I believe information should be free: free of charge, freely available. Please feel free to pass along anything I've written elsewhere.

BTW: The rule in the DRIM facebook group about reproducing posts is not lawful in the USA. The Fair Use Doctrine of the copyright law prohibits that silly rule. (Ok, got that off my chest)

nuwermj

TUG Member

Here is an update for 2017 of the comparisons. This year the conversion factors are obtained from Diamond's Club Combinations valuations (except Welk Resorts). Fees for the non-Diamond systems are trust fund fees (not deeds) for the respective systems.

nuwermj

TUG Member

This is Diamond's valuation data

- Joined

- Jun 6, 2005

- Messages

- 15,003

- Reaction score

- 3,963

- Location

- Kansas

- Resorts Owned

- Marriott Grand Chateau

Marriott Shadow Ridge

Marriott Ocean Pointe

Marriott Destination Club Points

Hilton Grand Vacation Club Las Vegas Blvd

Grand Colorado on Peak 8

Spinnaker French Quarter Resort Branson

Here is an update for 2017 of the comparisons. This year the conversion factors are obtained from Diamond's Club Combinations valuations (except Welk Resorts). Fees for the non-Diamond systems are trust fund fees (not deeds) for the respective systems.

View attachment 3364

I'm glad to see the comparison to MVC on this chart. As I suspected from our ownership, DRI is nearly as expensive as MVC and, what's worse IMHO, MVC puts a couple hundred dollars more into the cash reserves than DRI. If MVC put as little into cash reserves as DRI, they'd likely be even. Plus, DRI didn't have the quality or the quality of location in most destinations that MVC has, which is why we kept MVC and got rid of DRI. Both are very expensive systems to own but the quality or resort difference was, IMHO, staggering.

It would be interesting if HGVC was included in the matrix. I suspect people would discover what a value HGVC's system is compared to others in both price and value, except it just doesn't have the multiple location of many other systems.

youppi

TUG Member

It would be interesting to see the list of resort that you used for the comparison of each brand.Here is an update for 2017 of the comparisons. This year the conversion factors are obtained from Diamond's Club Combinations valuations (except Welk Resorts). Fees for the non-Diamond systems are trust fund fees (not deeds) for the respective systems.

View attachment 3364

youppi

TUG Member

It depends of the resort you compare. Each year I compare the 2 DRI Hawaii resort with their equivalent MVC resorts and DRI (HI Collection) is much cheaper most of weeks. Here is my 2017 comparison tableI'm glad to see the comparison to MVC on this chart. As I suspected from our ownership, DRI is nearly as expensive as MVC and, what's worse IMHO, MVC puts a couple hundred dollars more into the cash reserves than DRI. If MVC put as little into cash reserves as DRI, they'd likely be even. Plus, DRI didn't have the quality or the quality of location in most destinations that MVC has, which is why we kept MVC and got rid of DRI. Both are very expensive systems to own but the quality or resort difference was, IMHO, staggering.

It would be interesting if HGVC was included in the matrix. I suspect people would discover what a value HGVC's system is compared to others in both price and value, except it just doesn't have the multiple location of many other systems.

youppi

TUG Member

At regular cost, DRI is very expensive. The other brands, do they have discounted week like DRI (59 days and less @ 50% and many discount 25%-75% at many resorts during low season). At this moment, you can book a 2 bedroom at Polo Tower at 50% any week from today to mid November and at 75% off in May. Using those discounted weeks, you reduce a lot the cost of DRI.Here is an update for 2017 of the comparisons. This year the conversion factors are obtained from Diamond's Club Combinations valuations (except Welk Resorts). Fees for the non-Diamond systems are trust fund fees (not deeds) for the respective systems.

View attachment 3364

nuwermj

TUG Member

I'm glad to see the comparison to MVC on this chart. As I suspected from our ownership, DRI is nearly as expensive as MVC and, what's worse IMHO, MVC puts a couple hundred dollars more into the cash reserves than DRI. If MVC put as little into cash reserves as DRI, they'd likely be even. Plus, DRI didn't have the quality or the quality of location in most destinations that MVC has, which is why we kept MVC and got rid of DRI. Both are very expensive systems to own but the quality or resort difference was, IMHO, staggering.

It would be interesting if HGVC was included in the matrix. I suspect people would discover what a value HGVC's system is compared to others in both price and value, except it just doesn't have the multiple location of many other systems.

Doug, Thanks for your comment. Readers should take note that the figures for Marriott are Destination Points, which is Marriott's trust fund system. I'm not sure how Destination Point fees compare with fees for Marriott deeds.

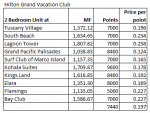

Regarding Hilton, I understand there is no ownership in a trust fund (it's all deeded), so the comparisons is more difficult. As a first approximation, I averaged fees (including Club Dues) for 2-bedroom units at ten locations. The data are taken from TUG's Hilton forum. Data were used only for owners who reported 2017 fees and the point value of their deed (see attached table). From this data, I get an average point value of 7440 for a 2-BR unit, and an average per point fee of $0.197. The average cost of this average unit is $1,465.67

Compared to Diamond, I averaged the high season point values for ten 2 bedroom units, which is 8600 points. At $0.207 per point, the cost is $1,780.20. Based on this data, Diamond's fees are 21% higher.

Last edited:

youppi

TUG Member

Also, the other problem comparing hybrid system (Hilton, VSE, Hyatt, Marriott's enrolled weeks, ...) with trust points is that the MF at a resort is the same whatever the season like any deeded week but not the number of point you will get depending of the season. Example, with Hyatt, the difference between the lowest season (Mountain) and the highest season (Diamond) is 10x points for the same MF. After Mountain, it is Copper season and the difference with Diamond season is 2x. So, if you own peak season, your cost per point is very low but if you own low season, your cost per point can be very high. So, you must also take the average of point per resort for the comparison. In general, people who post their MF are people who own peak season (the lowest cost per point).Doug, Thanks for your comment. Readers should take note that the figures for Marriott are Destination Points, which is Marriott's trust fund system. I'm not sure how Destination Point fees compare with fees for Marriott deeds.

Regarding Hilton, I understand there is no ownership in a trust fund (it's all deeded), so the comparisons is more difficult. As a first approximation, I averaged fees (including Club Dues) for 2-bedroom units at ten locations. The data are taken from TUG's Marriott forum. Records were used only for owners who reported 2017 fees and the point value of their deed (see attached table). From this data, I get an average point value of 7440 for a 2-BR unit, and an average per point fee of $0.197. The average cost of this average unit is $1,465.67

Compared to Diamond, I averaged the high season point values for ten 2 bedroom units, which is 8600 points. At $0.207 per point, the cost is $1,780.20. Based on this data, Diamond's fees are 21% higher.

View attachment 3394 View attachment 3395

- Joined

- Jun 6, 2005

- Messages

- 15,003

- Reaction score

- 3,963

- Location

- Kansas

- Resorts Owned

- Marriott Grand Chateau

Marriott Shadow Ridge

Marriott Ocean Pointe

Marriott Destination Club Points

Hilton Grand Vacation Club Las Vegas Blvd

Grand Colorado on Peak 8

Spinnaker French Quarter Resort Branson

I guess the reality is going always have to be adjusted to each persons own reality. As noted, HGVC's cost per point can vary greatly depending on where the ownership is deeded. We own a deeded week worth 7,000 points in Las Vegas, which is considerably lower in MF's than the same 7,000 points at Hilton Hawaiian Village.

MVC would be the same with deeded weeks converted to points sometimes being less expensive than owning pure trust points.

For us the breaking point was the comparison of our 2 deeded DRI Las Vegas Polo Towers weeks directly to our MVC Las Vegas ownership and our HGVC Las Vegas ownership. DRI was as expensive as Marriott but, lower quality units, furnishings and common area's. The comparison of DRI's Polo Towers to our HGVC LV Strip was even worse with the exception that DRI's location was far superior the HGVC LV Strip (North of Circus Circus and south of the old Sahara). But DRI was $1,300 plus THE Club membership while HGVC was $950 including HGVC's membership fee's. It wasn't hard to choose HGVC over DRI.

MVC would be the same with deeded weeks converted to points sometimes being less expensive than owning pure trust points.

For us the breaking point was the comparison of our 2 deeded DRI Las Vegas Polo Towers weeks directly to our MVC Las Vegas ownership and our HGVC Las Vegas ownership. DRI was as expensive as Marriott but, lower quality units, furnishings and common area's. The comparison of DRI's Polo Towers to our HGVC LV Strip was even worse with the exception that DRI's location was far superior the HGVC LV Strip (North of Circus Circus and south of the old Sahara). But DRI was $1,300 plus THE Club membership while HGVC was $950 including HGVC's membership fee's. It wasn't hard to choose HGVC over DRI.