Capital gain distributions don't trigger AMT but you're right it's possible to take the standard deduction and still pay AMT. Here's an article, assuming it gets the numbers right, saying for 2018 you need to be married and have AGI in the $290K-$765K range to be in that position.I do not itemize, I pay the amt. My income is from dividends, capital gain distributions, iras, annuities etc. some are from bonds, but not much.

The Senate Would Keep The Individual AMT, But Turn It Into A Very Different Tax

http://www.taxpolicycenter.org/taxvox/senate-would-keep-individual-amt-turn-it-very-different-tax

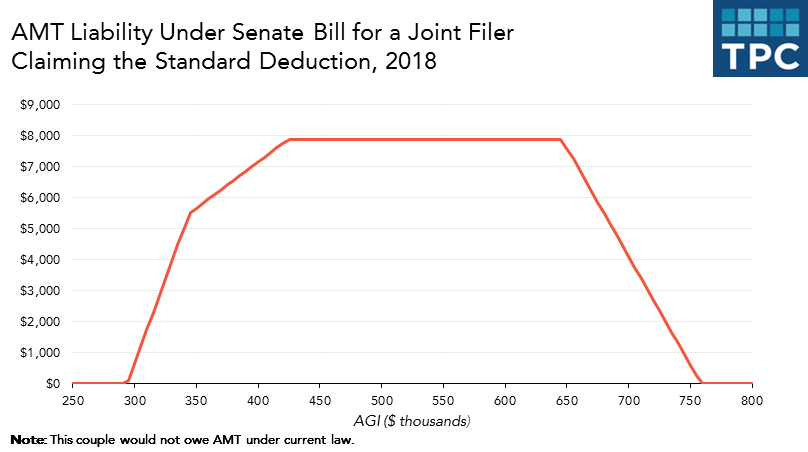

With about 90 percent of preferences eliminated from the regular tax, why would anyone pay the AMT? The answer: Because the Senate bill slashes individual income tax rates so much that all married couples with ordinary income between $290,000 and $765,000 would owe AMT even if they only claimed the standard deduction. In this simplest case, nobody with income outside this range would owe AMT. It turns out that single filers would be spared (because the Senate bill cuts tax rates more for high-income married couples than for singles), but they make up only about 10 percent of tax units in the affected income range.

Last edited: