I wouldn't put too much emphasis on the state income tax question. State income taxes even for higher earners in high-tax states max out at about 5% of total income--not necessarily a deal-breaker.

The big ticket items are housing costs (what you're selling, net of commissions and moving costs, vs. the purchase price in the new place), and real estate tax.

I'm more concerned about culture, climate, and quality of medical services (if there even is such a thing as quality medical these days).

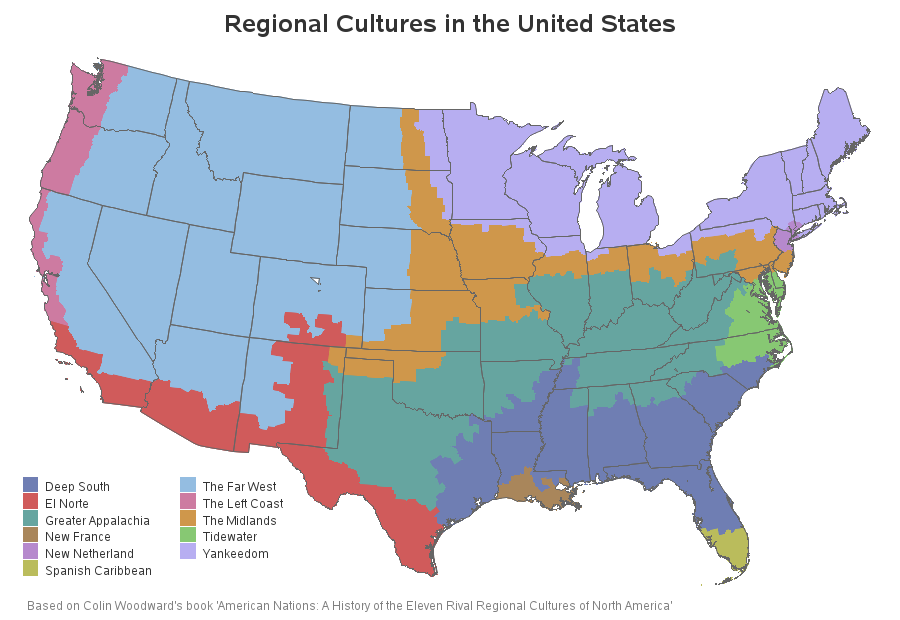

Culture:

https://blogs.sas.com/content/sastraining/2016/01/20/11279/

Climate:

https://en.wikipedia.org/wiki/Climate_of_the_United_States

Medical Services:

https://www.ahrq.gov/research/findings/nhqrdr/nhqdr16/overview.html

The big ticket items are housing costs (what you're selling, net of commissions and moving costs, vs. the purchase price in the new place), and real estate tax.

I'm more concerned about culture, climate, and quality of medical services (if there even is such a thing as quality medical these days).

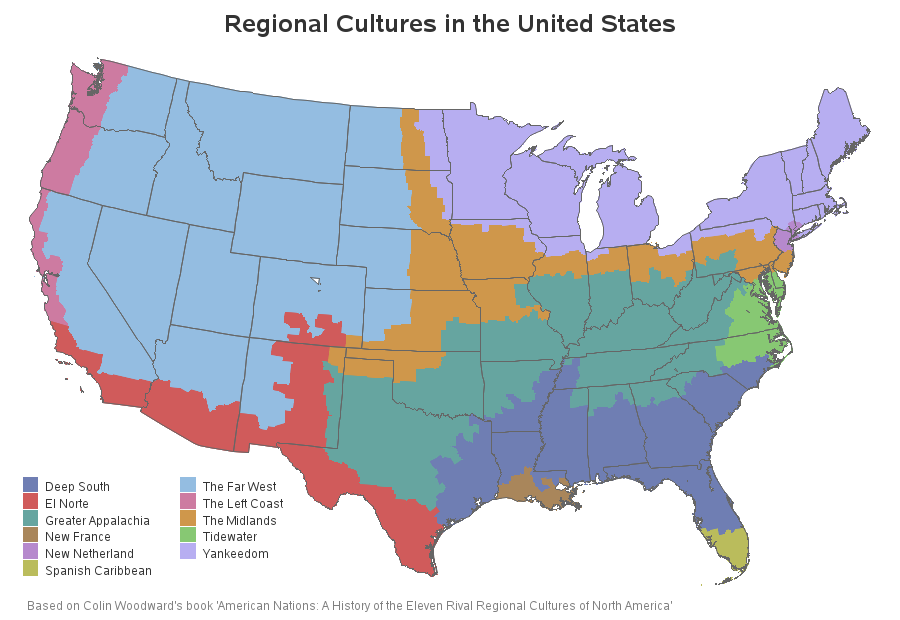

Culture:

https://blogs.sas.com/content/sastraining/2016/01/20/11279/

Climate:

https://en.wikipedia.org/wiki/Climate_of_the_United_States

Medical Services:

https://www.ahrq.gov/research/findings/nhqrdr/nhqdr16/overview.html

Last edited: