afettere

TUG Member

I'm looking to purchase a timeshare with HGVC that meets the following 'requirements' that I have:

So, with that in mind I found this property.

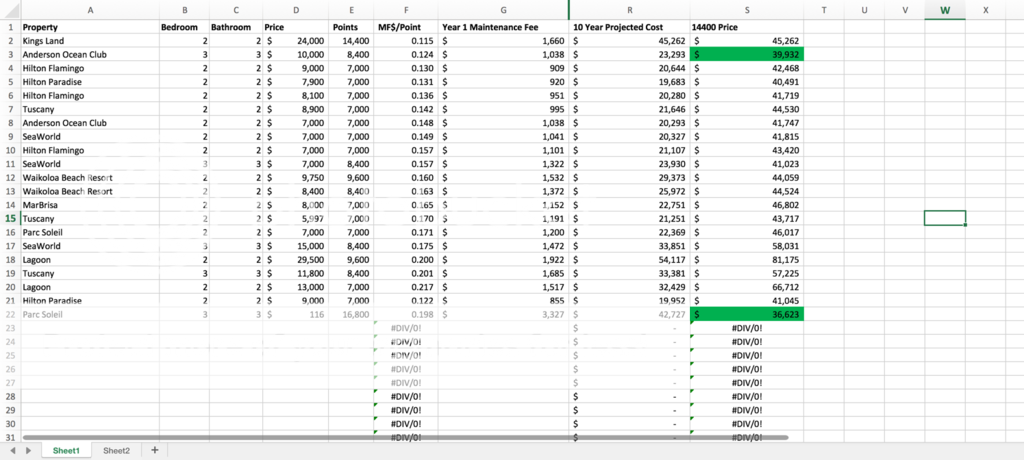

The dollar per point is higher than some other properties I've seen, but I also haven't seen many similar properties available...they have had fewer points.

My questions are as follows:

- A decent chuck of points that I can use for flexible travel

- is at a resort in a location I want (Hawaii, Florida)

- Platinum season

- is at a newer property

- 2 bedroom

So, with that in mind I found this property.

The dollar per point is higher than some other properties I've seen, but I also haven't seen many similar properties available...they have had fewer points.

My questions are as follows:

- assuming I can negotiate this down a bit to $20 - $22,000, is this a good deal TODAY

- would it clear ROFR

- how much better would it get if I wait to purchase something later in the year (I've heard that November / December is the best time to purchase)